Is market concentration actually good for craft brewers?

In the wake of Australia’s largest brewery describing the country’s beer market as one of the most profitable in the world, economists have highlighted the need for ongoing scrutiny to ensure a good deal for consumers and brewers alike.

Combined, Australia’s three largest brewers command more than 90% of the market share of the beer industry, and Flavio Menezes, Professor of Economics at the University of Queensland, highlighted concerns about the impact of this level of concentration on competition.

“What I can say is that there is a general concern about the state of competition and the effectiveness of competition law worldwide linked to increased concentration,” he said.

While Australia’s competition watchdog cleared the 2016 merger between AB InBev and SABMiller, Professor Menezes said that competition should not just be considered at the point of the merger, but as part of an ongoing, analytical process.

Any merger which could potentially affect competition or beer prices for the consumer should be at least scrutinised by the Australian Competition and Consumer Commission (ACCC) in the aftermath, he said.

Nicolas de Roos, associate economics professor at the University of Sydney, agreed that any market with this number of companies commanding such a huge market share is “very concentrated”.

However Professor de Roos, who earned his PhD at Yale University, also said that once a merger has taken place, market concentration is not necessarily the issue and that the ACCC would only scrutinise conduct that violates antitrust laws.

“For example, if there is any evidence of abuse of dominance or collusive practices, then the ACCC could certainly investigate,” he said.

For its part, the ACCC was unwilling to draw a link between concentration and profitability in the Australian beer market.

“Profitability of a sector can be influenced by many factors. Industry concentration can be a factor, as can supply and demand, tax and excise arrangements,” a spokesperson said.

Concentration and competition?

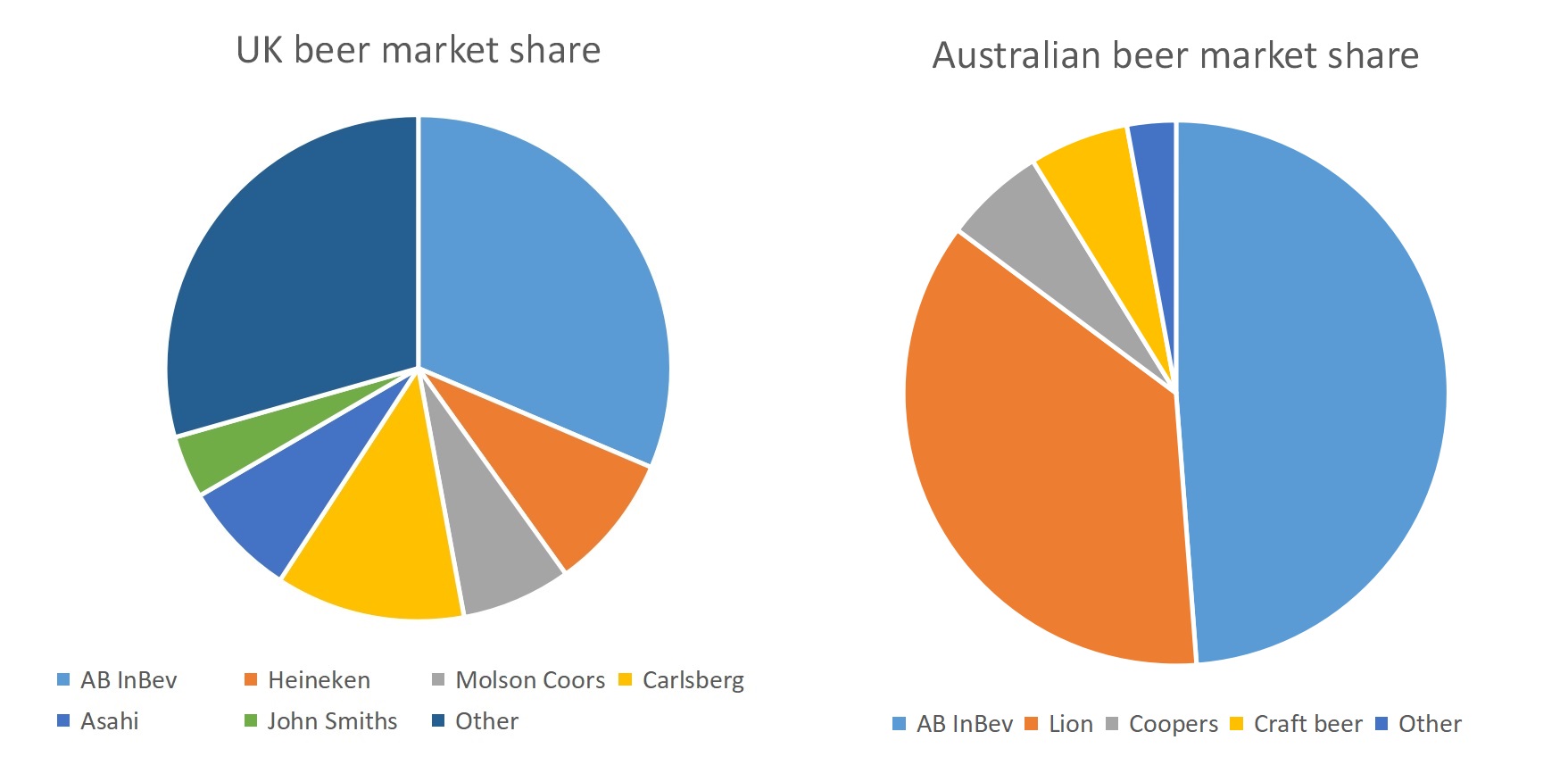

Australia’s beer market is highly concentrated in comparison with other countries.

In the UK, another mature beer market, there is a much greater diversity in terms of brands.According to consumer insights analysts at Kantar Worldpanel, AB InBev has a 31.4 per cent market share across three brands (Stella Artois, Fosters and Budweiser) with large shares for Molson Coors, Heineken, Asahi, Carlsberg and Yorkshire brand John Smiths.

UK data compiled by Kantar Worldpanel for Brews News

The remaining 29.4 per cent belongs to smaller international brands and craft breweries.

AB InBev itself, as the largest brewer on the market in the UK and Australia, has seen its fair share of competition-related difficulties globally.

In May 2019 the company received a €200m ($322.5 million) fine by the European Union for preventing beer imports from Belgium into the Netherlands.

At the time of the ruling, the European Commission said that dominant companies have a “special responsibility” not to abuse their market power by restricting competition.

In Australia, craft brewers complained to the ACCC that AB InBev-owned Carlton and United Breweries and Lion were locking them out of beer taps in multiple venues through exclusivity agreements.

Lion and CUB reportedly required venues to dedicate over 80 per cent of beer taps to their big name brands in exchange for rebates, infrastructure investment and refurbishment loans.

The watchdog investigated 36 venues but concluded the actions of the major brewers were “unlikely to substantially lessen competition in any of the markets we investigated”.

In 2005, the watchdog similarly declined to oppose Lion’s proposed takeover of Coopers, finding that while Coopers’ market share was growing its market share remained small, and substantially smaller than the two major beer producers in Australia, CUB and Lion Nathan.

“The evidence received in response to the Statement of Issues suggested that most competitive tension in the beer market is generated by competition between Lion Nathan and CUB,” then ACCC chair Graham Samuels said at the time.

Since 2005 Cooper has doubled its market share.

Concentration good for all price points

Jamie Cook, board chair of the Independent Brewers Association, said that while the market might be concentrated, any effect on pricing may not be a negative one for smaller brewers.

For small brewers, he said, it may even be a good thing, as having a dominating company or companies with higher price points means there can be little difference in the price of mainstream and craft beer.

“The market share [of AB InBev and Lion] is under pressure from two fronts, market decline and the rise of independent beer,” Cook continued.

“One of the benefits of having a market largely controlled by the two large brewers is that there’s a duopoly in place.

“They’ve been able to protect their margins. The beer market is profitable on a per litre basis for them, but this has also allowed small brewers to get in and take advantage of that,” he said.

Professor Menezes said that there was empirical evidence to suggest there is a positive relationship between market concentration and profitability – the more concentrated a market the more profitable it is for businesses that supply that area.

“There are at least two mechanisms that could lead to such a positive relationship: efficiency or less competition.

“Efficiency could result from a reduction in costs from the merger resulting in higher profits.

“In contrast, the merger could allow the constituent parts increased latitude in pricing, again resulting in higher profits. Increased profitability could also result from a mix of these two mechanisms in action.”

AB InBev has stated previously that Australia has a ‘high value per hectolitre of beer’ which Menezes said can be the result of a higher price or a lower cost or a combination of both.

He said you need to look at what happened with prices to determine whether the SABMiller merger in particular had an effect on consumers.

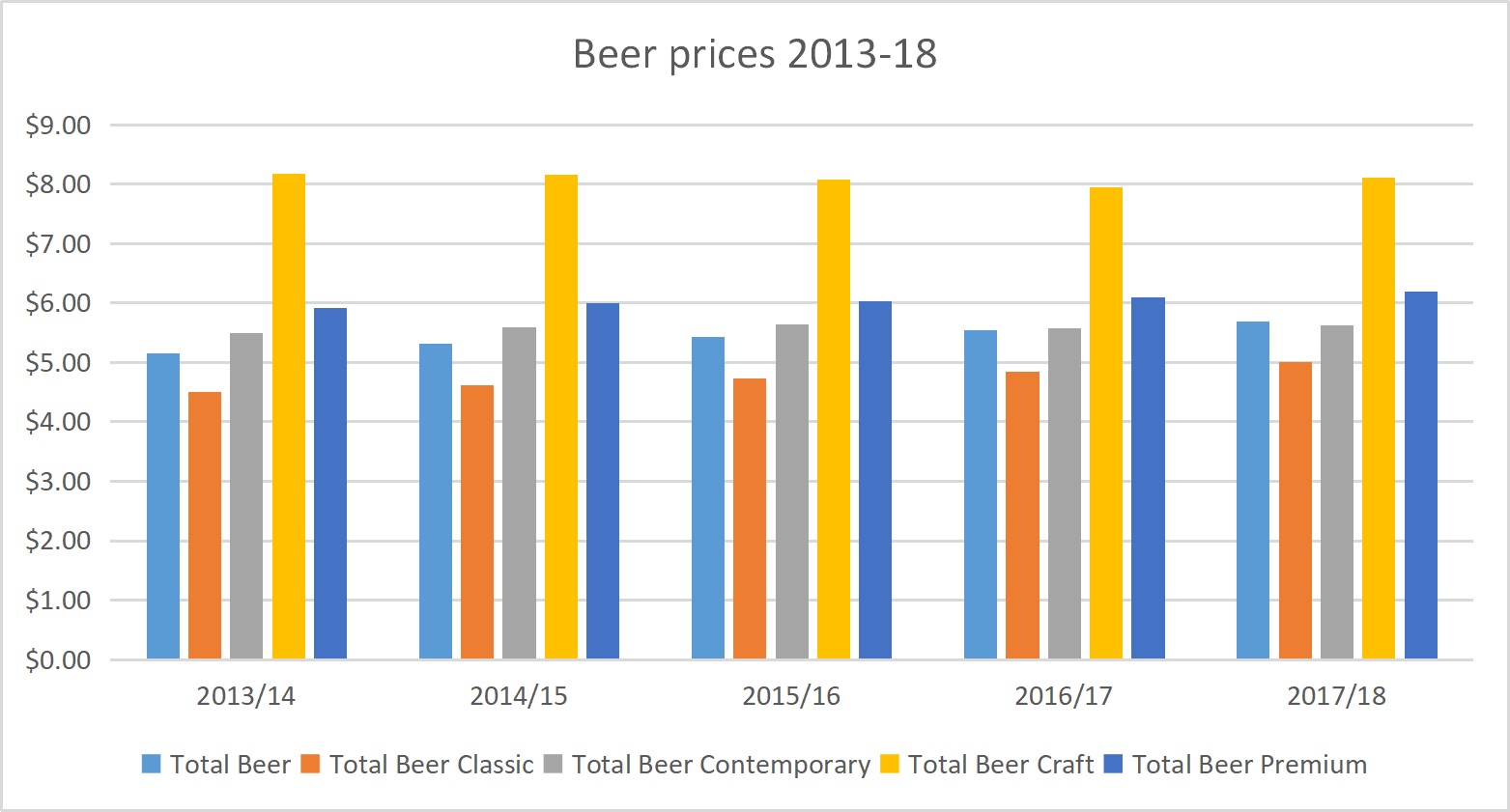

Data from IRI Worldwide highlights that the average price of beer had risen to $5.69 per litre.

Beer prices 2013-18. Data compiled by IRI MarketEdge Liquor

“Looking at the prices, they barely kept up with inflation – of course, it may well be that the prices of AB InBev beers have increased at the expense of competitors,” said Menezes.

“However, we look at the impact on competition – and not on competitors – so looking at these average prices, without doing any detailed analysis, my best educated guess is that the merger has not adversely impact on competition in Australia.”

A report by IBISWorld last year said that the craft beer industry in particular was still in its “growth phase”, though in terms of pricing, the IRI data shows that the price of craft beer has decreased from $8.17 in 2013/14 to $8.11 last year.

Further consolidation is expected in the craft beer space with IBISWorld saying that multinationals will be attracted by the high growth rates and premium pricing of the craft beer market, underscored in AB InBev’s APAC beer market report which emphasises a move to premium brands.

Still, craft brewers can still be confident of the future of the independent sector says Jamie Cook.

“We’ve seen acquisitions [by major brewers] in the last two years in Australia to try and compete in the craft beer space, but the trend of growth in independent beer continues,” he said.