Broo raises $400,000 through share issue

Beleaguered brewer Broo has raised $400,000 through an off-market share issue.

The ASX-listed brewery issued 20 million ordinary shares at $0.02 each under a private placement on Monday (1st July).

Executive director Kent Grogan told Brews News that Broo was “approached by an investor seeking an off market acquisition of Broo shares” and their application was subsequently approved by the board.

Broo has engaged in fundraising through share issuance before, raising $2 million in a placement of 10 million ordinary shares in August 2018 – a month before it released its annual reports. At the time, the “sophisticated investor” involved in the private placement paid $0.20 per share.

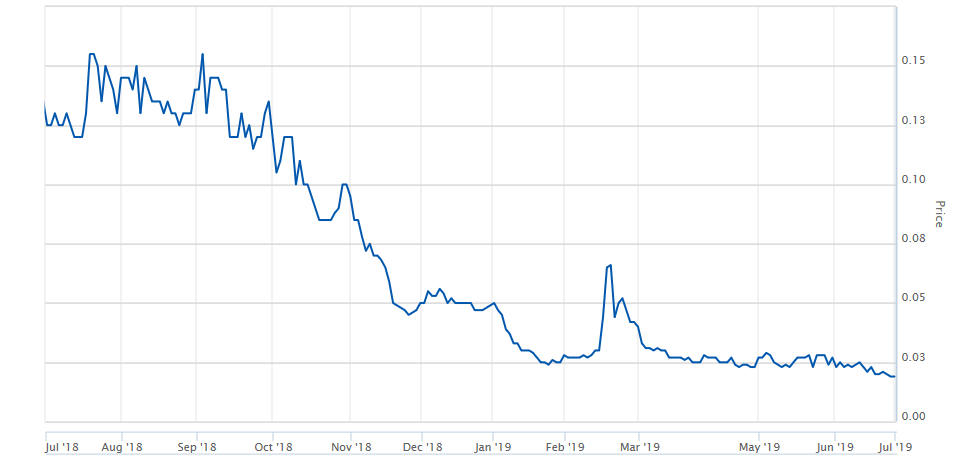

This comes following a period of volatile trading for the Victorian business, during which its fluctuating share price has damaged investor confidence.

Over the past 52 weeks, Broo’s share price has seesawed in a downward trend, from $0.16 at its height in July 2018 and again in September 2018, to lows of $0.02 over the past two months.

It was also forced to explain a spike in share price in February this year to a representative of the ASX, saying that it did not know of any information which would have been released to the market that would have caused the unexpected increase.

Broo share price July 2018-July 2019, courtesy of the ASX

This comes just under six months after its half year report in which the board of directors stated that there was “a significant or material uncertainty” about whether the business could continue to trade as a going concern.

Broo announced that it had made losses of $1.85m in the six months to December 2018. This was an improvement on the comparable period the year before, for which Broo reported $2.2m losses.

It insisted that while the business will continue to have negative operating cash flows in the short term, this would be rectified in “the current and future quarters”.

Prior to this, in November 2018 it was forced to defend itself and answer questions posed by the ASX about its cash flows.

At the time, a representative of the ASX highlighted the fact that if the company continued to expend cash at the rate indicated in its market update, it may not have sufficient capital to continue funding its operations.

However in a quarterly update in April this year, the company announced that while it had suffered further losses, it had experienced a quarter of “strong growth” driven by increased domestic sales which the company said had risen 86 per cent.

To help cut costs, the business swapped out its auditors in February 2019, and was preparing to sell land or get involved in a joint venture to release capital in land assets, such as those at Ballarat.

It declared that its review of corporate and operational costs have led to “significant reductions” and it expected “further reductions to follow in conjunction with release of new product lines and continued sales growth”.

Broo said that it expects to be profitable in the next financial year, prior to the first instalment of distribution fees from its Chinese contract.

The distribution agreement sees Beijing Jihua Information Consultant, a Chinese distributor, agree a ‘take or pay’ deal based on 1.5 billion litres of Broo Premium Lager over a seven-year period with Jihua paying a fixed rate per litre.

Broo values the distribution arrangement at approximately $120 million over the seven-year contract, and will see the first payout in December 2020.