Will hard iced teas take off in Australia?

Adding alcohol to what should be a soft drink isn’t a new concept, but the rise of hard seltzers and spiked iced teas has taken the US by storm, and it’s a trend that looks set to head this way.

Ready-to-drink beverages have been on the decline in Australia since their heyday in the 2000’s following a 70 per cent tax hike on the drink class in 2008 in efforts to deter young people from binge drinking.

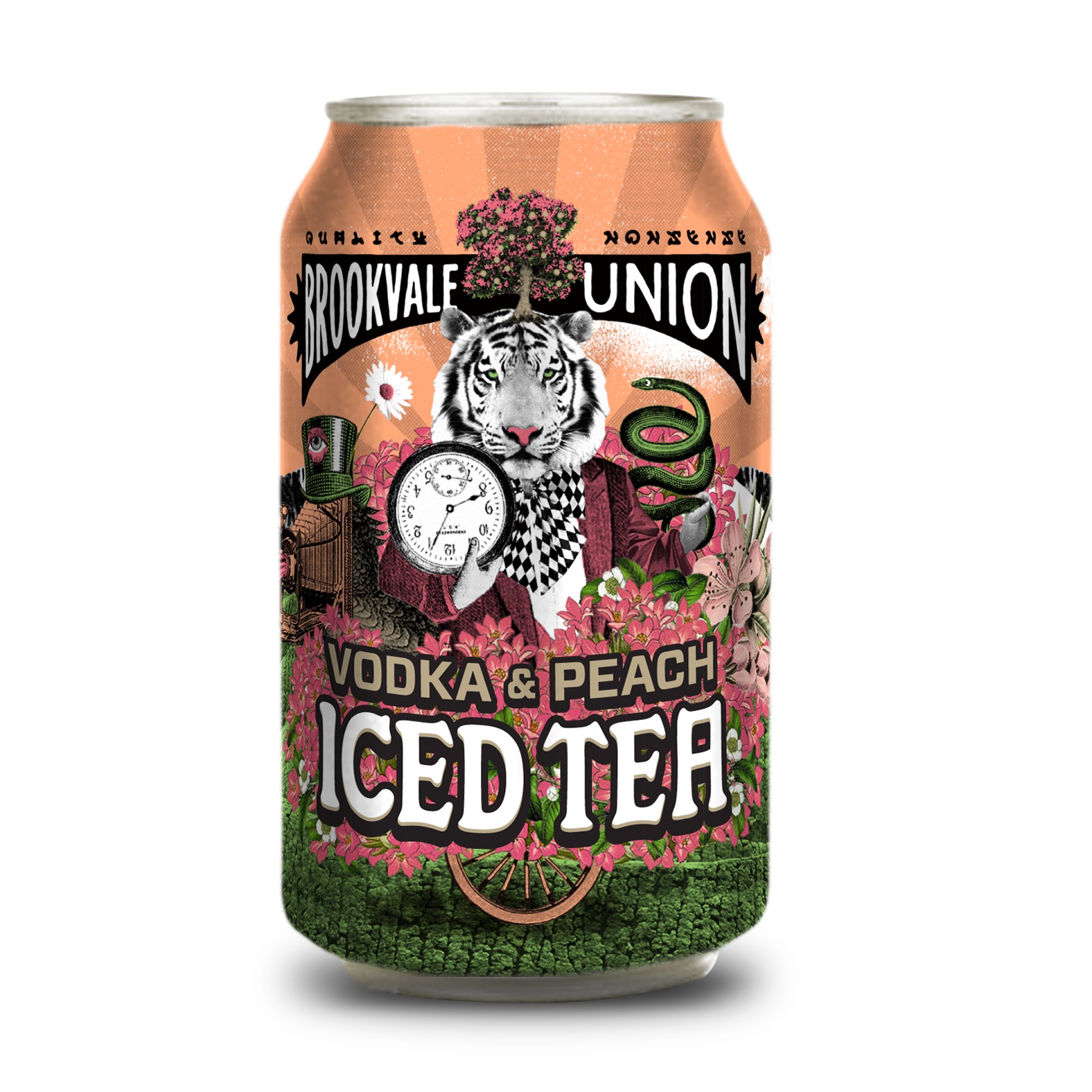

This decline has plateaued in recent years according to the Australian Bureau of Statistics, and if we follow US trends, as is usually the case, we could be seeing an uptick in RTDs.4 Pines-owned Brookvale Union, in turn owned by CUB, certainly thinks so and is hanging its hat on the trend with its latest offering, a Vodka & Peach Iced Tea.

With marketing involving the word “refreshalicious”, the launch highlights a movement towards alternative RTD-style alcoholic drinks – hard seltzers, spiked iced teas and alcoholic fermented malt beverages like ginger beer and alcoholic kombucha, each which come with their own issues.

A resurgence in alcopop-style drinks, but potentially without the sugar content of their predecessors like Smirnoff Ice, has come about due to a millennial-style focus on healthier alternatives, with many hard seltzers being marketed as low calorie alternatives to beer or even spirit mixers.

The move is also partially down to what is described as the premiumisation of the alcohol industry, as manufacturers scramble to come up with new ideas which can be sold at higher price points.

‘Premium’ itself is a pretty nebulous concept, and is largely to do with marketing – it’s the difference between buying plain table salt and investing in organic Himalayan pink crystal salt.

A 6-pack of Brookvale’s Vodka & Peach 4% abv Iced Tea costs $29.99 on BoozeBud, nudging it into this ephemeral ‘premium’ category.

Brookvale said the recipe for the Iced Tea is a “closely-guarded secret”, and they “don’t disclose the nitty gritty on exactly where they brew, ratios, production details/quantities” – although they did confirm that the peach iced tea does contain natural peach juice, not from concentrate.

Adopting an American trend

“Iced teas have been killing it in the US and Canada and we wanted to bring something like that here,” said Brookvale Union brand manager Andy Marsh.

“For us it’s about creating great-tasting beverages. There’s obviously some great examples of alcoholic iced teas in the US and Canada which is what we focused on as well [when coming up with the Vodka & Peach Iced Tea].”

He said the peach flavouring was something that tailored to the Australian market rather than that in the US.

“There’s a lot of lemon over there and our grocery trends over here are almost half split lemon and peach, so we went for something a bit different.”

He said that the fruit flavour was also inspired by innovations in the craft beer industry.

“In terms of the palate itself, you look at craft beer and you see a lot more fruit flavours coming into beer, citrus is definitely prominent in craft beer industry, and we’re all moving towards great fruit flavours.

“In terms of the 4% abv that’s looking at the trend of consumers looking at more sessionable drinks, they don’t go for the high abv, it’s all about sessionable liquids.”

This concern with alcohol levels has led to another trend, low and alcohol beer, with even big players like Lion investing in low-carb, low-alcohol, gluten-free beers, like Hahn Ultra Crisp.

In the United States the trend has seen craft breweries increasingly look to hard seltzers and flavoured malt beverages for growth. Deschutes is the latest brewery to announce a new line of flavoured malt beverages, as well as a low-calorie, low-carb hazy pale ale, called Wowza.

Brookvale is not ruling out investing in hard seltzers.

“I think the pipeline is ever-changing with consumer needs and trends, we’ve seen that’s as a great example of what they’re doing in the US, so we wouldn’t rule it out.”

An RTD renaissance

The 1990s and early 2000s saw the explosion of ready-to-drink beverages (also known as alcopops), which came to be seen as the bane of club life and underage drinking.

The market appetite for RTDs was quashed with the introduction of the alcopops tax in 2008, but it now appears to be reemerging in a new form.

IBIS World predicted that the alcopop market is expected to grow at an annual rate of 0.6% over the five years through 2018-19, to reach $967.8 million, and the market is beginning to see a greater demand for imported RTDs.

Their reemergence has already drawn fire from anti-alcohol organisation bodies including FARE.

“This is another appalling example of market development that contributes to normalising an addictive, carcinogenic drug in Australian society,” FARE chief executive Michael Thorn said.

However consumer appetite for the new generation of alcoholic beverages makes them an attractive target for brands such as Brookvale Union.

“We’re throwing the kitchen sink at it and we think it will be awesome,” said Marsh.

Brookvale Union’s Vodka & Peach Iced Tea comes in at 4% abv and will be available in 6 packs of 330ml cans from September.