Consumers want larger packs finds Beer Cartel survey

Beer Cartel has published the results of its 2019 Australian Craft Beer Survey, which highlighted industry trends, including the ongoing growth of online beer sales and customer preferences for larger pack sizes.

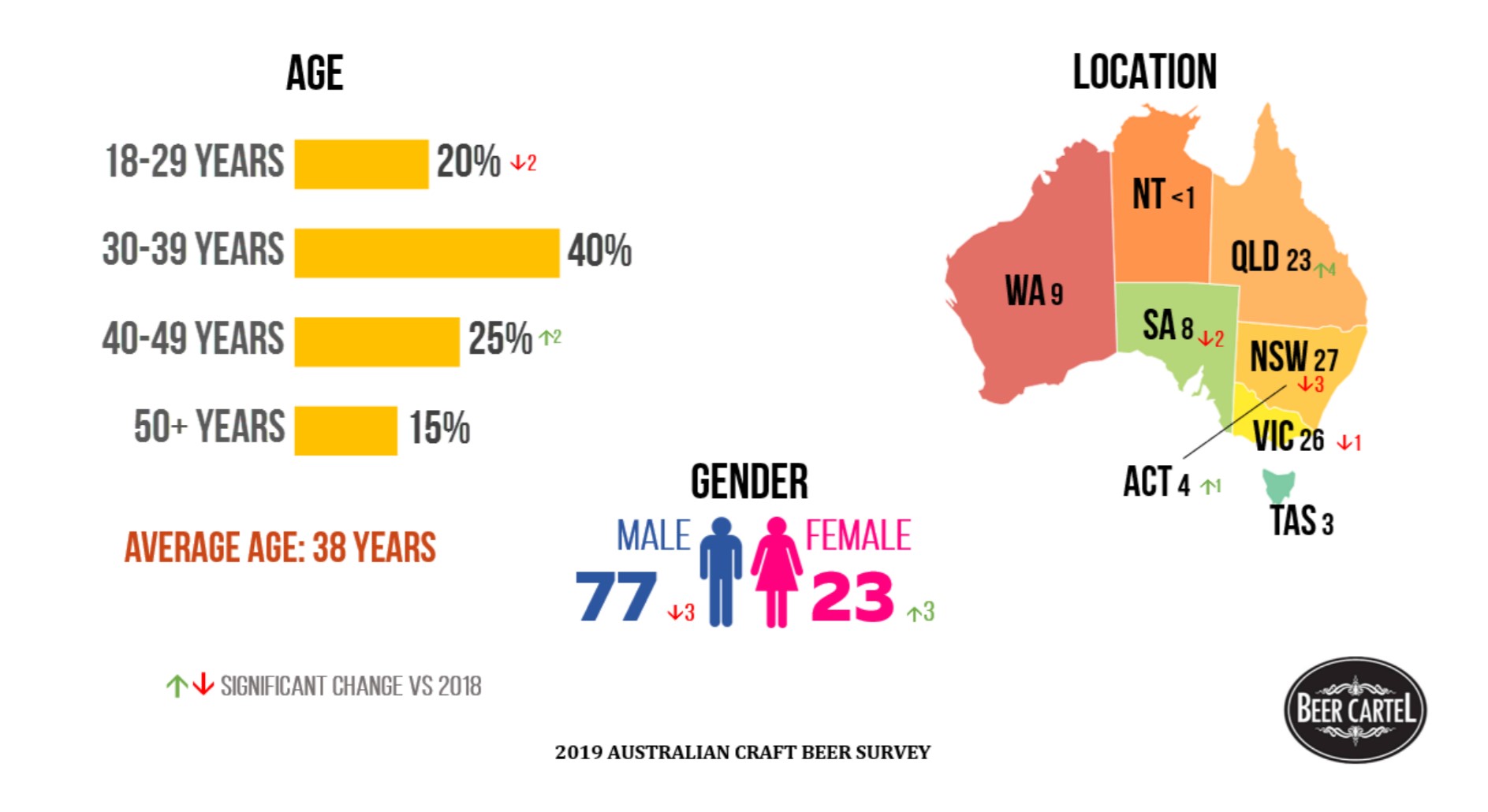

Twenty-three thousand Australian craft beer drinkers took part this year, up from 18,000 in 2018.

The survey found that craft beer drinkers prefer purchasing larger packaging options – in contrast to the shift by breweries towards four-packs and 16-can cartons.

Forty per cent of respondents said they bought singles regularly, another 40 per cent said they also bought cases regularly, whilst 75 per cent said they would usually buy a four or six pack.

Fifty-four per cent said they would prefer cases of 24 (coming in at $89.99) , as opposed to 16 (costing $59.99 to ensure a consistency of price per can), which 42 per cent of respondents said they preferred.

When it comes to smaller size packs, respondents overwhelmingly voted for six packs over four packs.

60 per cent of respondents who said they were regular buyers of four or six packs said they preferred a six pack – again, assuming the same price per can or bottle. 38 per cent they preferred four packs.

Perhaps unsurprisingly, cans have overtaken bottles for the first time when it comes to customer preferences. Can preference has grown eight percentage points to 38 per cent, while cans have dipped to 27 per cent. Thirty-five per cent of respondents reported having no preference.

Core beer ranges account for the majority of purchases, according to the results, which also found that a large proportion of people – 76 per cent – believe that the support of a brewery’s core range is important for its survival.

This is despite past research indicating that a large proportion of consumers are regularly drinking beers they’ve never tried, and that most respondents are “excited by the opportunity to try different beers”.

“Craft beer drinkers are largely positive towards the regular release of new beers by brewers. Most believe it showcases the skill of breweries and provides new and interesting beers that can be enjoyed,” said Beer Cartel.

The survey also highlighted changing buying habits of craft beer drinkers. 30 per cent now buy beer online at least every six months, compared to 22 per cent in 2018. The majority (65 per cent) of those reported buying from specialty beer websites like Beer Cartel (47 per cent), followed by liquor websites like Dan Murphy’s and then brewery websites (33 per cent). 60 per cent still prefer to buy in bottle shops or breweries.

When it comes to purchasing advice, friends and family are the most influential, followed by the brewery venue and then brewery staff.

Bottle shop signage and shelves also made the top five, as did social media, followed by bottle shop staff and beer news websites and emails.

Balter has been voted Australia’s best craft brewery for a second year in a row, followed by BentSpoke, Stone & Wood, Bridge Road Brewers and Black Hops.

When it comes to the IBA, awareness of its independence seal has grown from 33 per cent in 2018 to 41 per cent in 2019. Of those, 58 per cent say the seal has a medium to large impact on their beer purchasing behaviour. 23 per cent said it provided a small influence, and 19 per cent say it did not influence their beer purchasing decisions.

Overall 93 per cent of respondents said they believe the quality of craft beer in Australia is improving, with 89 per cent supporting independent craft beer.

However despite the support for indies, 40 per cent surveyed agreed with the statement “[I] don’t care who owns the brewery as long as they make great craft beer” with 34 per cent disagreeing – indicating quality over ownership as important to craft beer drinkers.