Craft contributes 'disproportionate' number of jobs to Aussie brewing industry

The Brewers Association of Australia last week released its latest report highlighting the number of jobs created by the Australian brewing industry.

The report, by market research firm ACIL Allen Consulting and commissioned by the Brewers Association, found that Australia’s three largest brewing companies – AB InBev, Lion and Coopers – account for 58.5 per cent, or 3,375, of the 5,765 full-time equivalent jobs delivered by the brewing industry. These jobs include those in the manufacturing, administration, marketing and other support jobs involved in making beer.

In terms of sales volumes, the report said that Lion, AB InBev and Coopers account for 79.4 per cent of sales volumes in the Australian market. According to a report published on AB InBev’s application to list its Asia-Pacific business on the Hong Kong stock markets , AB InBev and Lion together have a 93.6 per cent market share.

The report, commissioned by the Brewers Association – the peak body representing Australia’s largest beer makers, found that while craft brewers account for 3.4 per cent of sales volume the remaining 41.4 per cent – or 2,390 people – are employed by independent brewers and smaller international brands.

The Independent Brewers Association, which represents a majority of craft brewers, puts this number at around 2,700. It also recently released Australian Tax Office data showing independent brewers have a 5.9 per cent share of the market by volume.

IBA board director Jamie Cook highlighted the contribution by craft brewers to Australian employment figures.

“The IBA’s last estimate in relation to direct employment by independent brewers puts the number of indie brewing jobs at 2,700, which shows that the indie brewers contribute disproportionally to their 5.9 per cent [of market share],” he said.

Brewers Association CEO Brett Heffernan said this division of labour was not a surprise.

“The major brewers are producing exponentially more and consistently high-quality beer from far fewer sites, so the efficiency of their scale is a win for consumers,” he said

“It means Australians can enjoy the beers they love without having to pay the earth. Not many want to pay $15 for a beer at the pub.”

Interestingly, in its application to lists its APAC business on the Hong Kong stock exchange, AB InBev declared Australia “one of the most profitable beer markets globally” with a relatively high value per hectolitre compared to other markets.

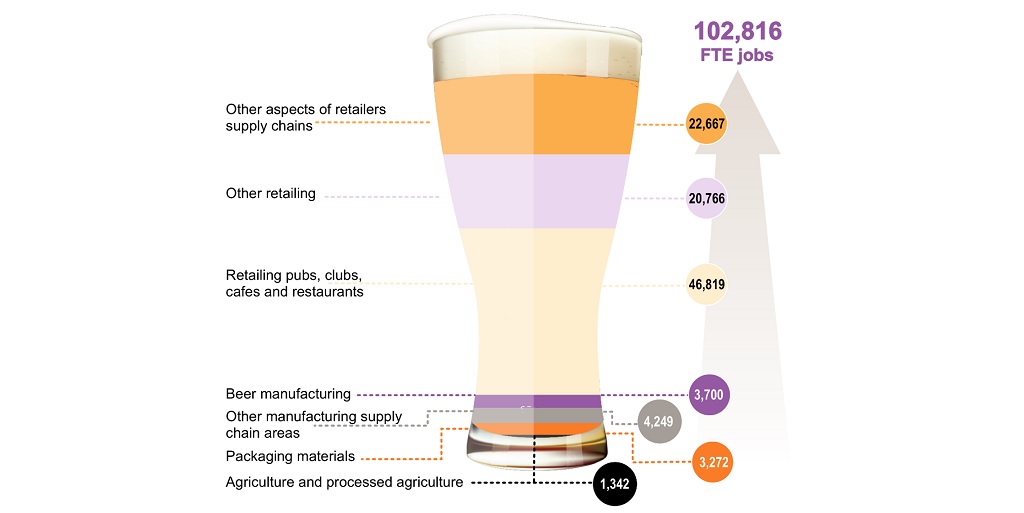

Overall, including retail and supply chain jobs, the report found that the brewing industry contributes 102,816 jobs to Australia.

Figures from the ACIL Allen Consulting report commissioned by the Brewers Association

The report found that in 2017-18, the production and consumption of Australian beers resulted in $16.5 billion of Australian economic output.

Brewers Association CEO Brett Heffernan explained that more than 80 per cent of beer consumed in Australia was made in Australia.

“Raising a glass is a part of who we are. Beer is a major ingredient in what brings families, friends, colleagues and entire communities together,” he said.

“But it is also an important lubricant for our economy at national, state and local levels.

“While the data for 2017-18 has tracked down slightly since 2015-16, mainly due to an increase in imports (up from 14 per cent to 16.2 per cent), beer in Australia is predominantly a domestic industry, with the three major local brewers (CUB, Lion and Coopers) accounting for 79.4 per cent of sales volume.

“Interestingly, despite the year-on-year exponential growth in the number of small brewers, they account for 3.4% of sales volume, with homebrew at 2.1% and imports at 16.2%. Exports run to 1.5% of domestic production volume.”

Australian beer drinkers poured $3.6 billion into government coffers, according to the report – which is just over $2.0 billion in excise and $1.6 billion in GST.

While the report notes the contribution beer drinkers make to Government coffers, some of Australia’s biggest brewers have been called out by the Australian Tax Office in recent years. SABMiller, former owner of Carlton and United Breweries , reportedly paid no tax between 2013 and 2016, and the ATO is currently investigating the brewer over $1.9bn in tax deductions it claimed when it was taken over by SABMiller in 2011.

In terms of beer trends, the Brewers Association Australia found that demand for light and mid-strength beers remained at a constant 26.5 per cent sales volume. However, the trend to lower strength beers has seen full-strength beers average 4.4% abv, down from the “once typical” 5% abv.

Heffernan said that the decline in alcohol consumption – which sees 84 per cent of Australians drink within recommended guidelines – was a “positive change”.