Indie brewers taking on budget beer

During the COVID-19 period, data showed customers were looking for value ranges and buying in bulk and a number of independent brewers rose to the challenge of producing more ‘budget’ beer.

Brisbane’s Ballistic Beer launched Brewunity, an “affordable, full-flavoured Australian Pale Ale”, whilst WA’s Otherside Brewing Co. released its Plan C affordable ale, a limited edition ale which went for $16.00 for a six pack or $40.00 per 18 can packs, and Hemingway’s Brewery in FNQ launched its Resilience Lager, a limited released “priced for tough times” which has now evolved into its Cancutter Lager.

Ballistic’s head of marketing Wade Curtis said that part of what the brewery wanted to do with its Brewunity ale is create an affordable option during the tough times of COVID-19, but they weren’t sure what to expect in terms of consumer demand.

“Brewunity was a concept that was received well, but our experience was that people would prefer to buy core range at discounted price,” Curtis explained.

“[A surge] happened early on and then sales plateaued a bit. People had full fridges and a lot of people stocked up, they bought more than they would normally buy but didn’t do that every week.

“They bought up for a couple of weeks and realised the world wouldn’t end and went back to normal purchasing behaviour.”

While ‘affordable’ bulk beer options from independent brewers were born out of necessity, it’s been a space that the big brewers have long dominated, and the question remains whether bulk budget beer will be a growth space for independent beer.

Cutting production costs for budget beer

Curtis said they managed to shave production costs for the Brewunity budget beer by using existing can and contracted ingredients stock, smaller labels and doing away with four-pack holders, instead selling them in a 24-carton rather than a four or a six pack.

“We played around with some cool stuff, like using Kviek yeast which throws pineapple esters in and also ferments really fast and reduces the amount of hops you need,” he explained.

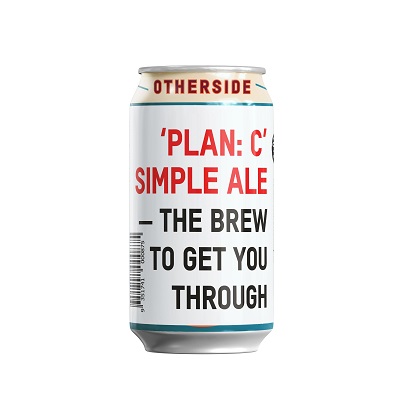

Meanwhile Otherside Brewing Co.’s Plan C – dubbed “the brew to get you through” came with a minimalist can design, and the company said that it worked with its brewers and suppliers to “invent a great craft brew at a price as reasonable as we could possibly make it”.

A simple ale, Otherside said it used all-Australian Pale malt and hops, as well as a label that could be applied to any can the brewers had on hand, thus keeping costs down.

Adapting to the challenge of budget beer has not been difficult for independent brewers in the short term, but the issue becomes murkier when price points are taken into consideration.

Price points

Part of the appeal of options like this during difficult economic times is clearly consumer budget, but it’s a tough market for independent brewers to move in, according to Curtis.

“There’s no real fat in the margin, and I think that [Brewunity’s] price point is a bit of a sweet spot – a $60 pack of craft beer was a no brainer. People would come in asking for two four-packs at $40, and we’d tell them they can get 24 for $60.”

He said the Ballistic team were considering whether to make Brewunity a permanent addition to its range.

“The jury is still out, but we were thinking we could sell it in our venues but back at that higher price point and donate the profits,” he said.

“Brewunity lends itself to community, we’re big on supporting local community, supporting local teams or fundraisers so maybe there’s a niche in our portfolio that we use to support community projects.”

The issue with budget beer is that it would be difficult to reach and maintain those economies of scale that the big brewers have perfected to enable relatively cheap beer to be produced and distributed in bulk.

Curtis said that this area has not been one where independent brewers have focused, and is already well serviced by CUB and Lion.

“The only way to do it is if you have a huge amount of distribution,” he said.

“So I’m not sure about [budget independent beer] as an overall trend. Some brewers might move down that price chain, but I don’t know many brewers that would be able to do it and get those big volumes.

“The way we structured Brewunity we could make a small profit, but I don’t know of any craft brewer who would be willing to go head-to-head with a large brewer in that space.”

He said that while lower price point is not a space that independent beer necessarily wants to play in, brewers were looking to more sessionable brews which have previously been the province of the major brewers.

“It’s the bitterness and high abv that have been a handbrake on take up outside craft beer drinkers,” he said.

“If we move more towards mainstream drinkers, there’s a whole bunch of people that might go from XXXX Gold to One Fifty Lashes and they might then go on to a lager and more easy drinking pale ale [from the independent sector].”

Sessionable and easy-drinking

While independent brewers may not necessarily be aiming for the budget, bulk section of the market, there has certainly been a move to more easy-drinking styles with lower abv such as lagers.

White Bay Beer for example recently launched with a core range which includes its European-style Union Lager, a 4% abv beer. Everyone from Young Henrys and Brick Lane to Your Mates and 10 Toes now has a lager and a number were included in the latest GABS Hottest 100, meanwhile Hemingway’s evolved its ‘affordable’ COVID-19 Resilience Lager into a whole new brand – Canecutter’s, a 3.5% abv lager.

“Lagers and mid-strength beers have really taken off for Hemingway’s Brewery,” according to Hemingway’s founder Craig Parsell.

“We see many reasons for the take-up of lower abv beers including lower pricing during challenging economic times, changing tastes to lower strength beers, and an increase in our reach to new customers trying “entry” level craft beers,” he said.

“Obviously our goal is to see these new customers gradually mature their tastes and become more adventurous across the broader range of our and other craft beers.”

So the move to sessionable beers by independent brewers may educate drinkers new to craft beer, providing a gateway to independent beer to those who may have traditionally been VB and XXXX drinkers.

However there are inevitable challenges with some easy-drinking styles such as lager, according to Ballistic’s Wade Curtis.

“We did our own research when we did our re-brand and it found that people were looking at more sessionable beers, like lagers or pale ales versus IPAs,”he said.

“A lot of brewers when they first open say they won’t do a lager. There aren’t so many esters in lager yeast so you get a cleaner ferment and any deficiencies in process will show.

“A true-to-style lager also takes longer to ferment, being brewed at 10-11 degrees rather than 18, so it will take sometimes take twice as long. Working that into pricing you’re not going to be able to do it competitively.”

However the ‘premiumisation’ trend in consumer habits which was prevalent prior to COVID-19 could also work in the favour of independent beer when it comes to sessionable styles.

“The things conspiring against lager, for example, were that it was previously being off trend and not sexy and that financial aspect of taking up tank time. But if you are drinking less you want to drink something perceived to be better than XXXX.”