NoLo growth continues despite low purchase propensity

Over the last 12 months, NoLo purchase propensity increased by six percentage points but is “nowhere near close to full penetration yet”, according to recent data from IRI Australia.

The market research company recently held its ‘NoLo Normalises’ webinar which provided insights on how the NoLo market has shifted over the past year.

Areas of focus included market performance, liquor occasion, consumer perspective, shopper perspective and product/service trends.

The data used within the webinar encompassed NoLo categories of beer, wine, cider, spirits and ready-to-drink (RTD) products, with results sourced from the IRI MarketEdge data, LiquorLens and shopper panel data and Growth Scope’s consumer usage and attitude panel.

The increase in claimed purchase propensity underpinned a 72 per cent gain in dollar growth via grocery and liquor channels combined, estimating annual sales to $152 million.

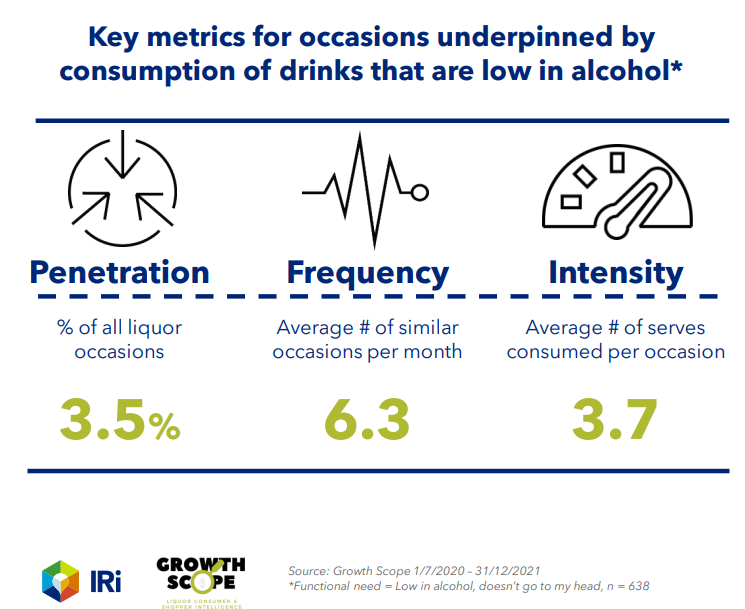

In contrast to this however, IRI found NoLo products had impacted less than five per cent of liquor occasions, which was analysed through metrics of penetration, frequency and intensity.

This is bolstered by trade mark research conducted by Brews News, which showed NoLo beer entrants outpacing the actual growth in the category.

“When we look at all these metrics combined, they’re actually low compared to full strength alcohol or regular alcoholic beverages on all three metrics,” Growth Scope research and product director Mel Anderson said during the webinar.

“But that doesn’t mean that NoLo is not important. It just means that it started from a low base, and therefore it has huge opportunity for growth.”

In terms of retailer channels, grocery held 41 per cent of NoLo market share, an increase by nine percentage points compared to last year.

“One to note as well as in terms of grocery really, the performance of RTD has been very, very strong in the last year there, which is why we’ve seen quite strong growth within that predominately off the back of Naked Life,” IRI liquor and tobacco consultant Antonia Tolich said.

IRI Liquor and Tobacco Director Mark McCaffrey agreed and said this will underpin future growth for the category.

“I think that’s probably where we’re going to see the strongest growth at this point in time in grocery and the support they’re putting behind it compared to, let’s say, traditional liquor retailers.”

NoLo beer performance

Over the last 12 months, NoLo beer accounted for over 60 per cent of alcohol-free sales however, lost market share by three percentage points, a trend expected to continue as other NoLo categories continue to gain market share, according to IRI liquor and tobacco consultant Antonia Tolich.

“We’re still seeing very, very strong value growth off the back of a lot of innovation from your bigger beer manufacturers, but actually losing share-of-throat to your other growing categories who are actually seeing very, very strong share gains.”

Great Northern Zero, James Squire Zero and Heaps Normal led NoLo beer dollar growth, with the latter having 18 per cent of the combined grocery and liquor market share.

“We’ve seen the rise of our more craft non-alc brands really seeing a lot of penetration gains in the last year and winning over some of your larger brands,” Tolich said.

“[It’s] actually overtaking the growth of some of our more established brands like Heineken, who are really sort of relying on grocery to drive growth but falling a little bit flatter in your traditional liquor channels where we’re seeing a lot more growth of our niche and our craft brands.”

In New Zealand, NoLo beer value growth increased by 23.5 per cent, based on unit growth of 17.4 per cent.

While Heineken held a market share of 61 per cent, Peroni’s no-alcohol offering, which just announced a rebranded portfolio, and Bavaria 0.0% had value growth of 28 and 67 per cent each.

What’s to come

In terms of trends, IRI claimed that the category would see a focus on utilising lower to mid-strength offerings, as seen recently with the announcement of Asahi Super Dry 3.5%, rather than just no-alcohol, to drive consumption.

“Not necessarily no-alc, but really we’re seeing a lot more innovation come through from your craft specialists, and that lower abv range,” IRI’s Antonia Tolich said.

In addition to this, IRI predicted the category will “blur the boundaries” and introduce “functional-based messaging” within its marketing.

“We have seen a lot more blurring of boundaries between your traditional sort of soft drinks categories and your beer as well,” Tolich said.

“So kind of blurring the lines between that functional benefit.”

The webinar highlighted international examples including Corona’s no-alcohol Vitamin D beer, which launched in Canada earlier this year and Danish brewer Mikkeller’s Racing Beer, which is positioned as a low-alcohol isotonic beer.

In Australia, Tribe Breweries redesigned its gluten-free brand Wilde earlier this year, to focus on more “better for you” alternatives. The company recently released its Wilde isotonic beer which is marketed as “beer for the everyday athlete.”

The full NoLo Normalises webinar is available to watch online now.