Details emerge of Stomping Ground buyout

Details have been released today of the acquisition of Stomping Ground by Good Drinks Australia, which put its upfront value at around $10.4 million.

Good Drinks (ASX:GDA) has been in a growth phase for some time, signing distribution agreements with major international brands, setting up venues and growing its east coast footprint.

In an announcement to the ASX todayit revealed the details of a “long courtship”, following which Good Drinks, the listed owner of Gage Roads Brew Co., acquired the business.

GDA paid $7 million in cash for the Victorian brewery, as well as 4.5 million ordinary shares in Good Drinks Australia, which are worth an estimated $3.4 million according to today’s share price.

The transition will be funded using debt facilities and ongoing operating cashflows from the business, so it will not require an equity raise to complete.

There were also deferred considerations based on volume performance, GDA told the ASX.

Up to 3.5 million ordinary shares over a maximum of five years are also on offer, based on 0.2 shares per litre of Stomping Ground volume sold – at today’s share price, this is worth around $2.6 million.

This will be issued annually, as will a cash sum which is estimated to be between $6 million and $8 million over five years based on current forecasts.

Deferred considerations could also see up to $1.2 million in cash based on Stomping Ground venue earnings, with a maximum payment based on an EBITDA target of $3.5 million in 2024, and another $1.2 million in 2025 based on venue earnings, with a target of $3.7 million.

In total the deal is potentially worth $30.4 million, if all performance targets are reached.

Founders Guy Greenstone, Steve Jeffares and Justin Joiner will become significant shareholders and join GDA executive and management teams.

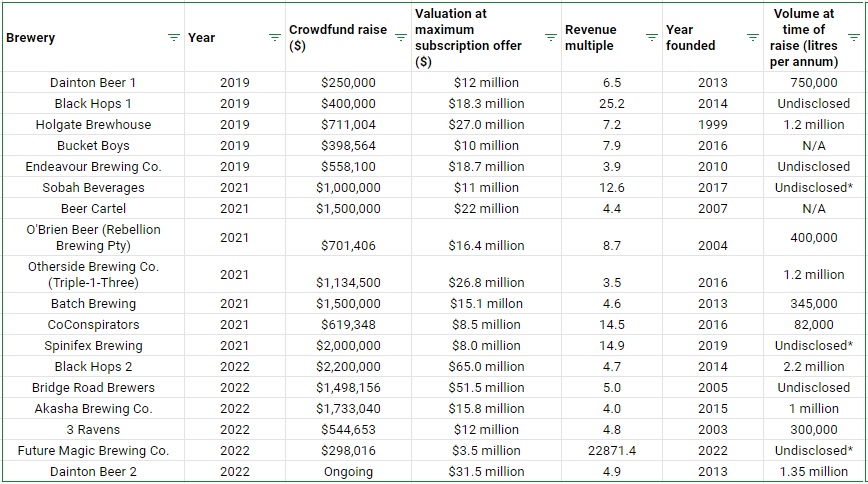

The transaction costs put into stark contrast the valuations currently being determined during equity crowdfunds.

Stomping Ground is expected to contribute $1.5 million to GDA earnings in its first year.

According to the release, the Victorian brewery, which owns two sites and a venue at Melbourne airport, has current volumes of 1.5 million litres annually. It is targeting capacity growth, with the aim of reaching 4 million litres by 2027.

Good Drinks told the market that there were “strategic benefits” on developing national brands relevant to key markets – of which the east coast has long been a target.

“There’s a shared ambition for Stomping Ground to become Victoria’s number one independent beer brand so this really is a win for fans of our beer,” explained Stomping Ground co-founder Guy Greenstone.

“With GDA’s help, our beers and brand will be more visible and available than ever before,” he said.

Good Drinks managing director John Hoedemaker was equally pleased.

“We’re excited about Stomping Ground joining the Good Drinks family and I know we can achieve more being on the same team. With a shared value of continuing to grow independent beer across the country, our combined skills, experience, and resources will help fast-track our goals.”

GDA’s head of strategy Aaron Heary explained that Stomping Ground had initially been seeking capital to fund a major expansion in its sales team.

“We were seeking to accelerate awareness and branded sales growth in Victoria through our existing venue strategy. During this process it became clear that the joining of the two businesses would achieve both objectives faster and more effectively.”

The deal comes at an interesting time for breweries who are reaching and exceeding targets and looking for other options for growth. Over in the US, many breweries are looking to sell in a competitive market and Australia could see similar trends in the coming years.

Meanwhile, many have turned to equity crowdfunding in the past few years, which have seen valuations come to the fore in the Australian brewing industry.

Crowdfunding valuations versus Stomping Ground’s $10.4 million sale price. *Brewery did not yet have their own venue/tanks.