The real implications of excise rebate changes November 2021

By Julian Sanders, Spark Breweries & Distilleries

When it was hastily implemented at the end of last financial year, Treasurer Josh Frydenberg’s update to the alcohol excise regulations was poorly reported as it relates to brewing businesses.

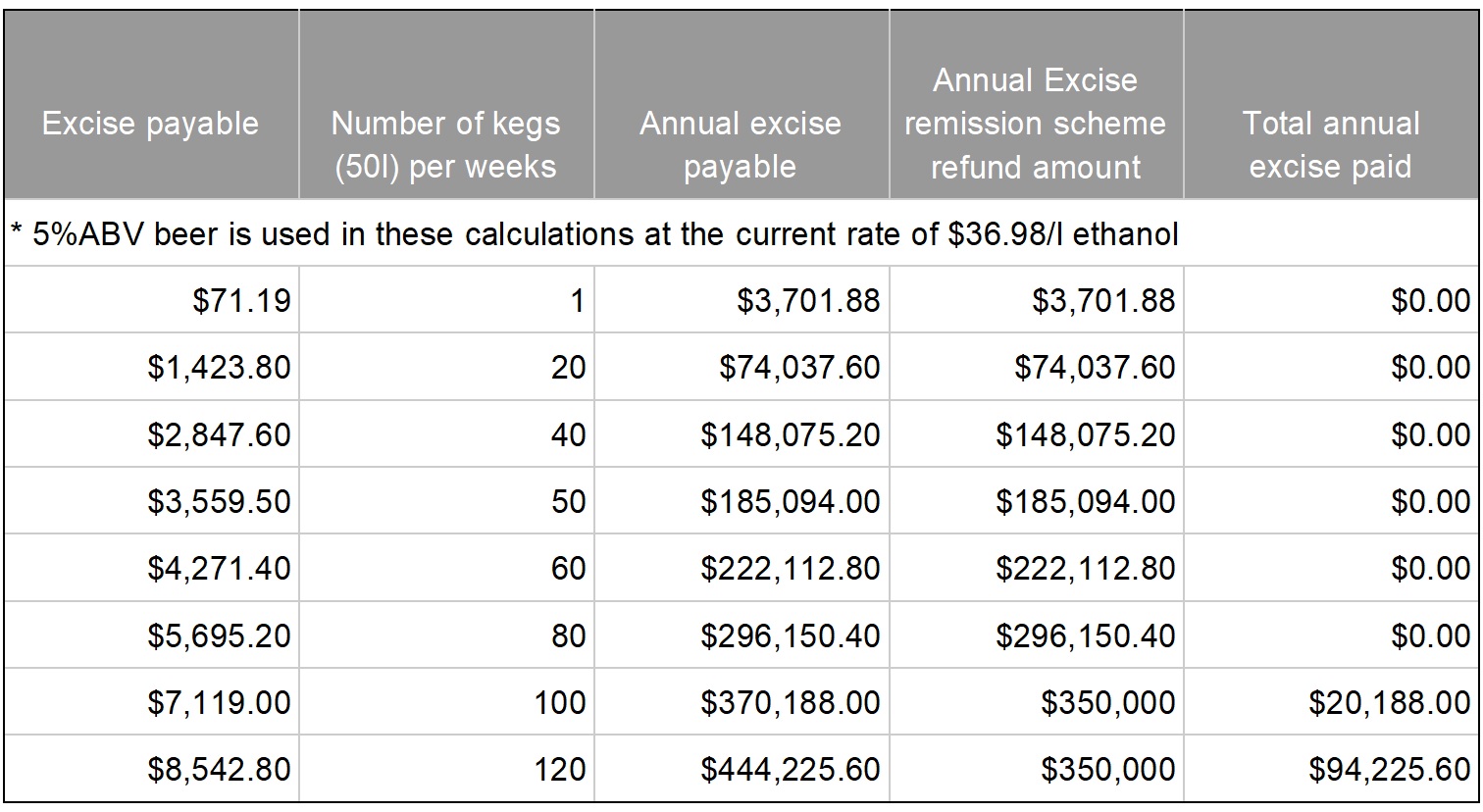

Most national media repeated the same copy along the lines that “the small brewers’ excise rebate threshold will be raised from $60,000 to $100,000 a year and the rebate will be increased” The salient point that they omitted was that it was increased from 60 per cent to 100 per cent.

Expressed better, excise this financial year has been completely removed for small brewers, who can now sell approximately 100 kegs per week of 5% abv beer and receive a $350,000 PA credit from the Australian Tax Office.

Furthermore, rather than remit the tax and have it rebated subsequently, the update avoids the levy in the first place.

The implications for both liquidity (cashflow) and profitability are very positive for the majority of brewers who will now pay no excise at all.

This policy helps to counter the natural economies of scale that have seen the brewing landscape consolidate last century down to only two participants, each with substantial market power.

When considered in the context of a restarting economy, the excise break in combination with instant asset write down and carry over tax loss offset is an unprecedented support package for industry.

Consider a business that lost money through COVID-19, but could bring forward previous years’ taxable profits to offset against those losses. The federal government is giving you a ‘pass’ by effectively crediting you back tax that was paid in the past.

The ability to then invest productive capital expenditure and receive a deductible depreciation of the entire amount, provides a huge incentive for brewing businesses and beer retailers to act in their own interests now that the worst of COVID is behind us.