Corporate history of Broo Pty Ltd

This is a detailed history of Broo’s announcements to the ASX since listing, including indexing, editorial and commentary on the business’ performance regarding its announcements, plans and delivery with links to original ASX filings.

August 2016 | Broo issues prospectus

Broo lodges prospectus seeking to raise $15 million through an issue of 75 million shares at $0.20.

Shares on issue: 555,518,040. With full capital raise will increase to 630,518,040 (11.89% of shares)

Founder and CEO Kent Grogan holds 412,425,000 shares through Groges Holdings Pty Ltd (ACN 109 818 000) and 1,000,000 personally, giving him a 65.57% interest, together with 41,342,500 Options in the company.

In the three financial years prior to the offer, Boo showed losses totalling $4,631,387.

At the date of the prospectus, Broo advised its Premium Lager was stocked in “a range of independently owned outlets, including those operating under banners such as Thirsty Camel, Bottlemart, Cellabrations, Bottle-O, Foodworks and Independent Grocers of Australia, liquor retailers, and a range of independent hotels and bottle shops.”

Intends to apply a portion of the funds to increasing production through its contract partner (Icon), increasing distribution and sales of the products in Australia. Will also look to establish own brewing facility in Australia to enable it to “develop independent brewing capacity” as well as activate the China Supply Agreement (Jinxing) and China Distribution Agreement (Henan Liquor).

“The company is continuing to receive interest from international beverage distributors located in the USA, Asia, and Europe.”

Subsidiaries:

- Australia Draught Pty Ltd (ACN 165 148 130)

- Broo Exports Pty Ltd (ACN 157 726 924)

- Broo (HK) Limited (HKCo) A company incorporated in Hong Kong. Following the offer, Broo intends to establish Broo China Ltd (ChinaCo) to conduct sales and marketing activities for Broo in China.

Company Directors:

- Kent Grogan (Chairman and Executive Director)

- Matthew Boyes (Non-Executive Director)

- Geoff De Graaff (Non-Executive Director)

- Phillip Grundy (Non-Executive Director – to be appointed upon the successful completion of offer)

Offer scheduled to close 19 September 2016.

12 October 2016 | Broo Limited (BEE) admitted to the ASX

Broo Limited (BEE) admitted to the ASX, raising $10,546,374 with the offer of 52,731,871 shares, 22,268,129 fewer than the total available.

A total of 608,249,911 were listed (full raise would have been 630,518,040).

A total of 7112 shareholders were listed.

- 6362 held between 1-1000

- 64 held between 1001 – 5000

- 264 held between 5001 – 10,000

- 314 held between 10,000 – 100,000

- 108 held more than 100,001

4 October 2016 | Shares list

Broo Limited opened its fourth day on the ASX with a market cap of $288 million, the brewer’s shares having last traded at 250 per cent higher than the issue price. The shares were listed at 20c on Friday October 14, soaring to a peak on Tuesday morning of 61c.

The company achieved a market cap on listing of AUD $121.6 million with existing shares taken into account.

28 November 2016 | Broo secures nationwide distribution deal in China

Broo announces Jinxing will now distribute the beer made under the supply agreement. CEO Kent Grogan describes the agreement as a “game changer and will dwarf our original sales expectations”.

The announcement does not refer to the Henan Liquor distribution agreement outlined in the IPO prospectus or whether this agreement has any impact on it.

Shares spike on the announcement.

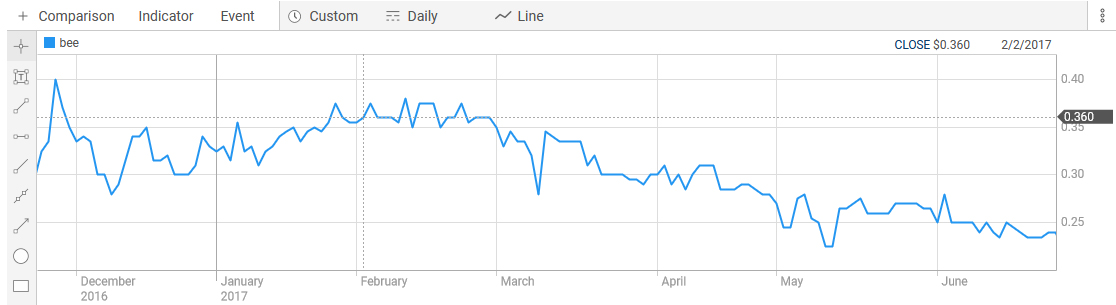

Broo Share Price at close 28 November 2016

2 February 2017 | Acquires Mildura Brewery

Brew announces to ASX it has acquired the Mildura Brewery from chef Stefano di Pieri. In the announcement to the ASX Broo advises the acquisition will “provide the Company with a commercial brewery facility to immediately commence its own beer production, providing the Company with the opportunity and capacity to expand distribution of its beer products nationally.”

It also states the facility “will significantly reduce current production costs in turn providing increased profitability across sales of existing brands”.

Kent Grogan tells the AFR that he paid $1 million for the brewery. He also said he was confident the facility could produce five million bottles a year.

Broo closing price 02 Feb 2017

14 February 2017 | Half Yearly results

Announces half-year loss of $1,465,564

15 February 2017 | Trading Halt

Broo requests a trading halt pending an announcement

17 February 2017 | Land purchase for ‘World’s Greenest Brewery’

Broo announces purchase of 15 hectares of industrial land in Ballarat within the Ballarat West Employment Zone (BWEZ) for $2.16 million with plans to develop the ‘World’s Greenest Brewery’ over the next 24 – 26 months. The company says the brewery will be capable of producing up to 480 million bottles of beer (*180 million litres, based on 375ml) “making it one of Australia’s largest breweries”.

The company “engages” Krones to plan and pre-engineer the brewery with a “submission” from Krones for the plant and a quotation for the brewery kit of $95 million. (*essentially, Broo sought a quote for a brewery).

Announces plans for the brewery, visitor’s centre and hospitality venue, beer museum, Energy Education Centre and recreation, entertainment and cultural activities to house concerts, expos, markets and outdoor events.

The company is “exploring a range of funding opportunities for the development of the brewery”. Grogan tells the AFR he was in talks with several potential financiers and also with high net worth individuals on the financing of the brewery. “We’ve got funding options in front of us,” he said.

Grogan tells the Adelaide Advertiser he aims to power the $100 million brewery entirely with renewable energy, using a mixture of solar, wind and biogas.

“The Ballarat site will be funded through debt and government grants and produce at least 480 million bottles a year — supporting Broo’s distribution network in China and at home.

Mr Grogan said the site, scheduled to be opened in the second half of next year, was likely to be the nation’s third biggest in terms of annual production, surpassing the Coopers Brewery operations in South Australia.

“We’ve got some of the largest distributors in the world chasing our product and this gives us the scale to meet that demand,” he said.

Share price close 17 February 2017

6 March 2017 | Completion of Mildura Purchase

Broo announces completion of Mildura purchase

21 March 2017 | China Production Commences

Broo announces production under the Jinxing supply agreement commences. “The activation of production and distribution of Broo Premium Lager in China has been the company’s focus and the final step to realising Chinese revenues.”

29 March 2017 | Market Update on Venues

Broo announces:

- Closure of Mildua for refurbishment, pending reopening week of 3 April 2017

- Commencement of brewing at Mildura Brewery with its own production facility providing it with the opportunity to expand production with continuous production and supply and also significantly reduce production costs providing increased profitability.

- Acquisition of Sorrento hospitality venue – takes over the lease of a bar on Ocean Beach Road, Sorrento for $45,000 (incl stock). Plans to refurbish 1500sqm site and rebrand as Sorrento Brewhouse.

- Entered into Heads of Agreement for the lease of a site in Delacombe in the “western growth centre’ of Ballarat. Located in the town centre, the company intends to establish ‘a hospitality and bar operation’. Site currently under development, but handover anticipated for November 2017. Operation will “expand its hospitality model and make an initial step to retail” beer in Ballarat where its ‘major brewery’ will be located.

31 July 2017 | Market Update

- Broo announces completion of first production run under the Jinxing supply agreement, with video from Zhang Feng, Director of Jinxing Beer Group. Broo is working with Jinxing and distributors in relation to marketing and distribution within China. Discussions underway with other significant distributors in China.

- Broo enters a national distribution agreement with Australian Liquor Marketers (ALM) boasting ALM’s access to network of 14,500 hotels, liquor stores and restaurants. Promises to roll out aggressive national sales and marketing strategy to optimise new distribution.

- Announces upgrades and automation of Mildura to increase capacity and provide greater efficiencies. Announces focus on Broo Premium Lager, Australia Draught, Kakadu and Mildura brands. Increased capacity will allow Broo to contract for third party beer with discussions for this “well advanced”.

- Announces Krones has competed “planning, engineering and manufacturing design specifications” of Ballarat Brewery and is working with architectural firm Decibel Architecture. “Over the coming 12 months, Broo Brewery will be seeking to obtain the necessary planning and development permits for the project”. Currently in discussions with potential joint venture partners while also ‘pursuing opportunities to secure Government incentives and grants’.

29 September 2017 | Annual Report

- Broo reports loss of $3,488,544.

- Notifies loan facility entered into with Manda Capital Holdings Pty Ltd, secured against Ballarat property. Loan of $1,228,125 (inclusive of prepaid interest and fees and council rates). Broo receives $965,380.

- Mildura Brewery upgraded to 1.5 million litres

- Expected to secure revenues from China sales during the 2018 financial year and is currently negotiating further distribution agreements.

- Reveals Mildura Brewery land not purchased by Broo but by a company owned by Directors Kent Grogan and Geoff De Graaff, Mildura Brewery (AUB) Pty Ltd.

- Cost of brewery plant & equipment was $200,000.

- Subsidiaries now include:

- Broo Franchising Pty Ltd

- Broo Exports Pty Ltd

- Australia Draught Pty Ltd

- Broo (HK) Limited (HKCo) (Hong Kong)

- Broo Beverages Pty Ltd

- Sorrento Brewery Pty Ltd

- Broo Brewery Pty Ltd

- Mildura Brewery Pub (Broo) Pty Ltd

- Direct Liquor Outlet (DLO) Pty Ltd

- Broo China (China)

31 October 2017 | Operations Update

October update notes:

- Agreement with ALM activated and first orders filled in Queensland. Broo “planning to roll out into other states in the next quarter”.

- Mildura Brewery made significant changes transitioning the venue from “a fine dining establishment back to a Brewery pub”. “Beer consumption and patron numbers are steadily rising”. Since reopening in April 2017, the venue has seen increased sales volumes in every month.

- Sorrento Brewery has secured a 10-year lease for the 1500sqm site.

- China – Broo & Jixing Beer Group are both pleased with the results of what is now described as a “pilot roll out” program, and discussions are also ongoing with “significant national distributors in China”.

23 November 2017 | Trading Halt (Company)

Broo requests a trading halt pending the release of an announcement.

27 November 2017 | Major Chinese Distribution Agreement

Broo announces it has entered into a binding agreement with Beijing Jihua Information Consultant Ltd (Jihua) to market and distribute Broo Premium Lager for 7 years.

The exclusive agreement will “enormously accelerate the expansion of Broo Premium Lager” in the “lucrative Chinese beer market”.

Jihua will purchase Broo Premium Lager from Broo’s approved manufacturer in China and Jihua will fund the marketing and promotional costs for the brand. The agreement is “binding on a ‘Take or Pay’ basis for 1.5 billion litres of beer over the 7 years with Jihua paying a fixed rate per litre. Broo predicts revenue of RMB602 million, or approx AUD $120 million.

Jihua commits to significant upfront marketing and advertising funds and Broo defers revenue payments for three years with payments continuing on a 6-monthly basis thereafter.

Given this is an exclusive deal, no mention is made of the distribution arrangements with Jinxing or Henan Liquor.

Broo Share Price close 27 November

31 January 2018 | Market Update

This update notes:

- Broo’s average share price since the listing is 31.67 cents.

- Mildura Brewery “continues to operate at capacity” enabling Broo to increase domestic sales with product now available through ALM. Full-year sales increase of 407 per cent, though update doesn’t note value/volumes to gauge the base for growth.

- Mildura Pub continues to see increases in patron numbers and sales volume.

- Sorrento Brewhouse to open this week having undergone extensive refurbishment.

28 February 2018 | Half Yearly Report and Accounts

- Despite reporting revenues being up by 259.4% over the same reporting period the year prior, Broo posted a $2,204,810 loss for the half year.

- Upgrades to the Mildura Brewery are expected to contribute operating cash flows in the region of $210,000 over coming months.

- Broo has entered into agreements to provide contract brewing services through Mildura. The board is confident that Broo will be able to sell Mildura’s full production capacity.

- Sorrento Brewhouse is now fully operational and the Board expects it to make a significant cash flow contribution.

- Board is exploring ‘realisation strategies’ for the Ballarat land, including potential JV or sale.

- Board is reviewing operations with a view to reducing costs.

- Following the reporting period (9 February), a director-related entity provides a loan of $250,000 on 10-year term interest free.

- Following the reporting period (27 February), a director-related entity provides a loan of $750,000 interest-free. Loan repayable 1 December 2020.

2 March 2018 | Board Changes

Announcement of Matthew Newberry as a Non-Executive Director.

Mr Newberry, currently General Manager of McGuires Hotels – one of the largest family-owned independent hotel groups in Queensland. brings a wealth of experience and contacts in the liquor and hospitality industry.

Phillip Grundy and Geoff De Graaff resigned due to other commitments with their respective careers, however, Mr Grundy will remain closely involved as one of its external legal advisors, and Mr De Graaff will remain as one of its major shareholders.

De Graaff Holdings Pty Ltd has 9,376,570 ordinary fully paid shares, and 41,376,570 escrowed until 14 October 2018.

Phillip Grundy has 150 ordinary fully paid shares, and 5,000,000 options with an exercise price of $0.30 expiring 4 July 2020 (escrowed until 14 October 2018).

Matthew Newberry has no shares in the company.

30 April 2018 | Market Update and Quarterly Results

Reports a cash loss of $620,000 for the quarter. Cash on hand at end of quarter $892,000 due to $1 million loan from director-related entities.

- Jihua has commenced sales and distribution, including to its major customers COFCO and Wumei Ltd (Wu Mart Supermarket Chain) covering more than 20 cities and districts. Jihua has “received great feedback from customers and is looking forward to a successful summer”.

- Broo is focussing on Australian distribution with availability expanded beyond Queensland and now available nationally via ALM. Working state-by-state with retail banner groups.

- Retail performing strongly, with Mildura and Sorrento trading in line with forecasts. Pleased with increased margins.

- Progressing with masterplans for ‘World’s Greenest Brewery’. “It has taken considerable time to finalise and compile all facets of this development including consultants reports as was expected with a project of this magnitude. These reports alongside project costings are currently being tabled for the development of the brewery and production facility. I further update on the project will be provided in due course.”

31 July 2018 | Market Update and Quarterly Results

Reports a cash loss of $833,000 for the quarter with cash-on-hand of $639,000, after a loan of $600,000.

- Jihua continues to grow sales and distribution in China with Jihua to provide a report on total sales volumes at the conclusion of Chinese summer.

- Reports wholesale revenues up 66% and total revenue up 163% with a roll-out to new liquor groups in NSW/ACT, South Australia, Western Australia, Queensland and Victoria, naming Supabarn, RD Jones Group, LiquorBarons, Buck Off Liquor.

- Broo Retail “continues to operate in line with forecast expectation”. Sees this category “provide increased gross margin”.

- Name checks World’s Greenest Brewery restating the promises but without update on progress.

31 August 2018 | Preliminary Final Report

Reports loss for the year of $4,212,224

31 August 2018 | Broo raises $2M through share placement at $0.20 per share

Broo announces it has raised $2 million through a private placement to a sophisticated investor of 10,000,000 shares at $0.20 per share. The placement is made under the 15% placement rule. Broo says funds will be used for working capital.

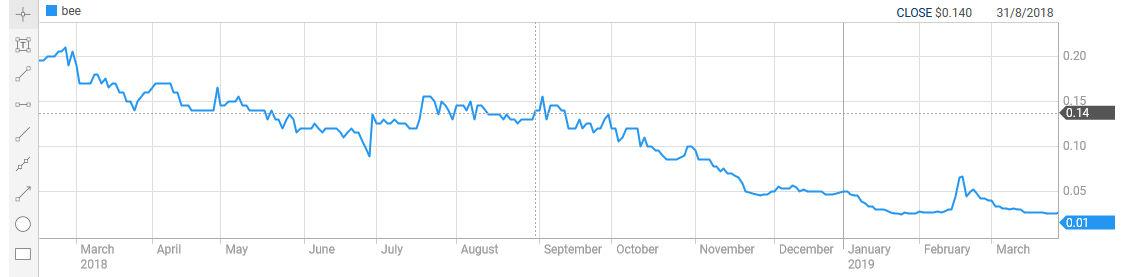

Broo Share Proce and Sales Data close 31 August 2018.

28 September 2018 | Annual Report

Annual report reveals loss of $4,436,359 and restates:

- Jihua agreement worth $120 million over 7 years, without updating from April report.

- Broo retail (Mildura and Sorrento) continue to see increases in patron numbers and sales volume with increased gross margin.

- Continues to focus on domestic sales and distribution through ALM and has engaged with independent liquor retail groups.

- Restates promise of World’s Greenest Brewery without updating progress towards it.

- On 15 August extends loan facility of $1,228,000 until 15 October 2019.

Cash on hand at end of financial year $638,834, following $600,000 proceeds received in advance of the issue of shares (announcement 21 August 2018) and borrowings of $2,342,000.

Loan facility of $1,228,000 with Manda Capital (29 September 2017) extended until 15 October 2019. Secured by Ballarat site.

The auditor notes that inventories have been built up on the expectation of trading demand, noting that these are perishable and there is a risk of stock reaching its sell-by date. Auditor raises a number of audit issues giving rise to a material uncertainty of Broo’s ability to continue as a going concern.

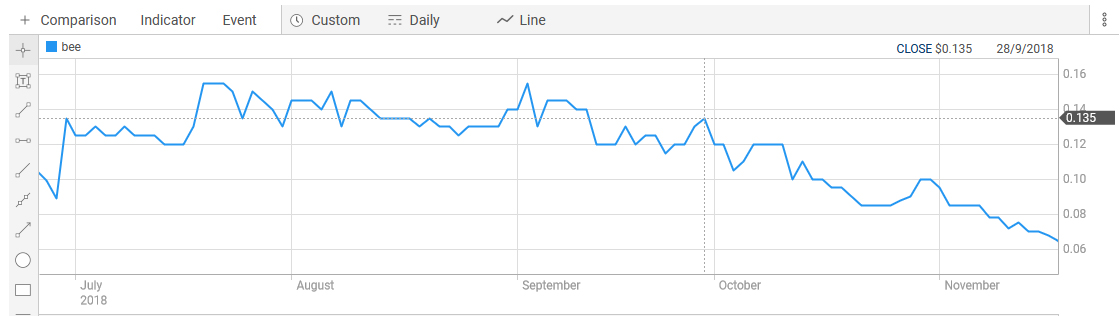

Broo Share Price at close 28 September 2018

28 September 2018 | Shares and Options release from Escrow

470,252,070 shares and 58,342,500 unlisted options (exercisable at $0.30) released from escrow.

22 October 2018 | Notice of Annual General Meeting

Notice of Annual General Meeting lays out a resolution to appoint George Georgiou from Connect Audit & Assurance Services Pty Ltd as auditors. This is subsequently passed at the AGM and on 8 February 2019the company secretary notifies the ASX that ASIC has consented and the change is to “reduce audit costs”.

25 October 2018 | Quarterly Report and Market Update

Reveals an operating loss of $1,001 million. Incurs production costs of $430,000 (for sales of $646,000) despite having substantial inventories revealed in last quarter.

Finished previous FY with $638,834 cash on hand, finishes this quarter with $832,000 despite $1.4 million received as proceeds from share issue.

- China wholesale volume of 19.2 million litres, “in line with the Year 1 forecast expectation of the binding agreement”. China distribution focusing on “rural areas including second and third-tier cities.” Broo recently hosted executives from Jihua to discuss a range of possibilities, including a tour of World’s Greenest Brewery site and Mildura.

- An export opportunity was identified and the first purchase order of four containers due to depart that month.

- In Australia reports continued wholesale growth, still focussed on increasing domestic sales thanks to expanded distribution through ALM.

- Mildura and Sorrento “performing strongly” and trading in line with forecasts.

- The company is still in discussions with potential joint venture partners about the World’s Greenest Brewery.

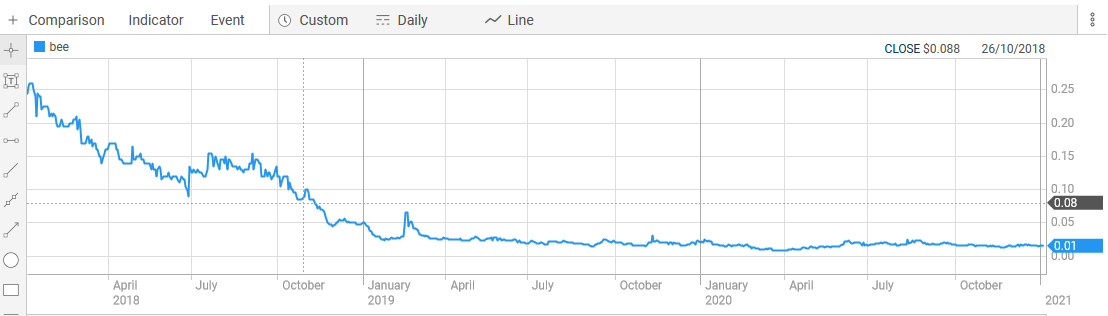

Broo Share Price Close 25 October 2018

8 November 2018 | Response to ASX Query

On 2 November 2018 the ASX raises questions around Broo’s operating cash flows. Broo advises:

- That it expects that it will continue to have negative operating cash flows in the short term however negative net operating cash flows are expected to decrease in the current and future quarters.

- The board believes that it will be able to raise sufficient capital to continue to fund the business activities.

- The company anticipates cash receipts from customers to significantly increase in the current quarter and that cash outflows will be less than forecast.

- Funds can be raised via private placement, if required.

31 January 2019 | Quarterly Results and Market Update

Broo records an operating loss of $387,000 despite sales of $989,000. Starts quarter with $832,000 on hand, ends with $306,000 for a cash loss of $520,000.

Market Update notes:

- Restates focus on domestic sales through ALM and independents.

- Mildura and Sorrento “performing strongly” and in line with expectations, providing increased gross margins.

- Jihua “continues to grow sales and distribution” in China.

- Still in discussion with potential JV partners regarding World’s Greenest Brewery.

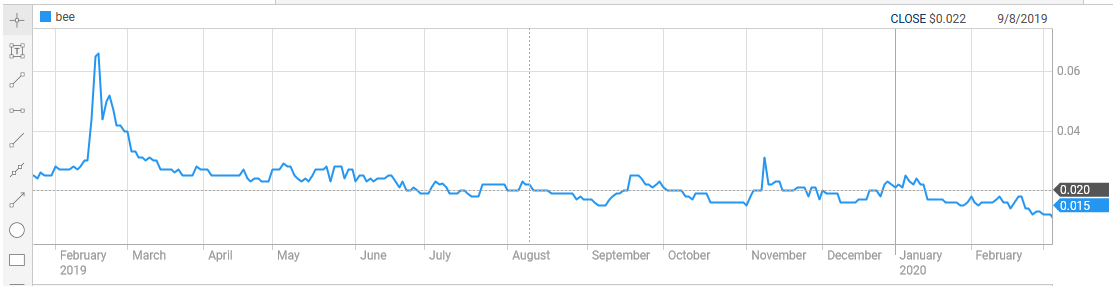

18 February 2019 | Trading Pause (ASX)

The ASX pauses trading and queries a share price rise from $0.06 to $0.27 with a significant increase in volume. Broo advises it is not aware of information that has not been released to the market.

Broo Share Price and Sales Data close 18 February 2019.

28 February 2019 | Half Yearly Report and Accounts

Broo reports a first half loss of $1,853,106 despite revenues of $1,667,381. The increase in revenue for the half grew by $378,816 over the same period the year before, but the cost of goods sold grew by $532,738. Inventories also decreased by approx $200,000 from the annual report three months earlier.

Cash on hand has decreased to $306,923 (from $638,834) despite share issue of $1.4 million.

*Curiously the accounts note a loss for the Chines brewing operations of just $2,192, while the previous first half report reported a loss of $226,979 and a full year cost of $340,437. The beer purportedly being sold under the Jihua agreement is being made in China under the Jinxing supply agreement. For significant sales to be taking place in China, production outlays would need to increasing to cover the cost of the goods being sold.

The notes to the financial statements advise that despite the material uncertainty that the business can continue as a going concern, but the board believes it can continue as a going concern for the following reasons:

- The company is exploring realisation strategies for the Ballarat land, including a potential joint venture or sale

- Exploring selling Broo’s other assets

- The company has a proven ability to raise capital by both debt and equity and can access further funding if required over the next 12 months to pay debts

- Administration costs have been reduced from $1.6 million to $1.3 million the board is reviewing the Broo’s operations and has identified significant further cost savings

30 April 2019 | Quarterly Activites Update

Despite highlighting wholesale, retail and consolidated revue increases, Broo still records a loss of $137,000. It notes “significant reductions” in costs, though these appear to have come predominantly through a reduction in manufacturing costs, which could indicate beer is not being produced.

“The company is confident of becoming profitable next financial year prior to the first instalment of Chinese distribution fees.” The report proceeds to outline the payments due under the Jihua agreement, including a payment of $19,610,000 by 31 December 2020.

Outlines Queensland is its strongest market and so announces plans for reelae of Australia Draught Mid Strength which will be launched in the upcoming quarter through established distribution channels. The beer will be “aggressively priced”.

“The company has developed further brand innovations specific to emerging high margin categories, announcements to follow this quarter.”

Cash on hand $169,000.

1 July 2019 | Issue of shares

Broo issues 20,000,000 shares at $0.02 per share, a significant discount from the 10,000,000 shares placed at $0.20 per share on 31 August 2018.

31 July 2019 | Quarterly Results

Loss of just $3000, with $400,000 share issue leaves $484,000 on hand at end of the quarter, costs have reduced especially product manufacturing.

7 August 2019 | Supply Agreement with East End Group

After asking for a trading halt on 6 August, Broo announces it has entered into a trading agreement with “Queensland independent wholesale network, the East End Group“. The agreements provide East End with “exclusive Queensland distribution rights” for Broo Premium Lager (4.2%) a new product.

Distribution rights subject to East End meeting annual sales targets of 2 million litres during the initial 12-month term from August 2019.

“The East End distribution network comprises established wholesale and retail operations that collectively rank as one of Queensland’s largest independent wholesalers. Over the past six months East End has grown to be one of Broo’s most valued trading partners, with proven distribution capabilities of brews existing products.”

*The East End ‘East End Group‘ is the East End Hotel in Bundaberg and associated bottleshops.

With the agreement exceeding the capacity of the Mildura Brewery, Broo issues a supplemental announcement advising that it will be looking into external contract arrangements.

Broo Share Price and Sales Data close 07 August 2019.

30 September 2019 | Annual Report

Broo reports an annual loss of $3,182,989. In its review of operations, the company says the losses were “as expected” and the company is continuing to reduce operational costs. The company “is focused on significant Australian expansion over the next 12 months”. The review doesn’t mention China.

- The loan facility with Manda Capital Holdings (over the Ballarat land) has been extended until 15 October 2020.

- The company is in negotiations for outsourcing brewing requirements.

- These outsourcing arrangements mean the company doesn’t require its Mildura brewery. Once the contracting brewing agreement is in place, Broo’s Mildura operations “value can be realised”. (*editor’s note. The company didn’t buy the land just the brewery, the land was purchased by a business owned by directors Kent Grogan and Geoff Geoff De Graaff. See more in Mildura Brewery)

- The board is in negotiation with several parties in relation to further funding, both debt and equity are being considered.

- The Sorrento Brewhouse business has been placed on the market and the board is considering proposals. (The business was listed, but then taken off the market.)

*Note: the annual report only attributes costs of $2,373 to Chinese Brewing (c/w $340,437 in 17/18 FY). Brewing would appear to have stopped in China, which Broo would be aware of.

Auditor notes Broo incurred a net loss of $3,182,989, which exceeded its current assets by $3,034,406.

31 October 2019 | Quarterly Results

Broo reports a quarterly loss of $371,000

1 November 2019 | Kent Grogan sells share parcel

Broo notifies the ASX that Kent Grogan (Groges Holdings Pty Ltd) has sold 10,000,000 shares off market for $160,000 ($0.016)

2 December 2019 | Shares issued in lieu of director’s fees.

Broo issues additional 6,022,500 in lieu of unpaid director’s fees, issued at $0.02 per share as outlined in AGM notice.

- Matthew Newberry – 2,007,500 shares (accrued Director’s fees of $40,150)

- Matthew Boyes – 4,015,000 (accrued Director’s fees of $80,300)

24 December 2019 | Kent Grogan sells share parcel and private placement. New CFO.

Broo notifies the ASX that Kent Grogan (Groges Holdings Pty Ltd) has sold 61,250,000 shares off market for $980,000 ($0.016)

Broo also issues $50,000,000 shares at $0.01 to “professional & sophisticated investors”.

Broo also announces the appointment of a new CFO, Adrian Siah. “Adrian is an experienced finance executive who has previously worked in senior roles in commercial management and investment banking”.

On 8 January, Broo advised the ASX that Gem Syndication Pty Ltd has become a substantial shareholder as a result of Kent Grogan’s sale. The purchase of 60,000,000 shares from Kent Grogan gave Gem Syndication 8.61%, of the company at $0.016 per share.

ASIC records show that Gem Syndication Pty Ltd is owned by another company, CEA Syndication Pty Ltd, with Teik Leong Siah listed as a director. The Australian Business Register records Adrian Siah as the trading name of Teik Leong Siah. The registered address for Gem Syndication is Gem Realty.

Mr Siah has been registered as a licenced estate agent in Victoria since 2014, and is listed as an agent at a number of Melbourne-based property firms, including Gem Realty (profile deleted after questions from BrewsNews) and red23 Real Estate. His agent profile describes Siah as “a career accountant turned real estate professional”. He is also on the board of The Environmental Group Ltd, where he is described as having ” as well as broad connections in the investment community and in South East Asia.”

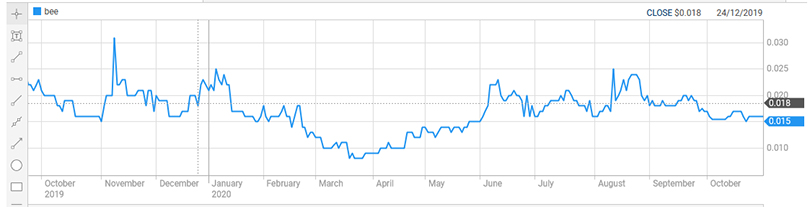

Broo Share Price close 24 December 2019

31 January 2020 | Quarterly results

Broo announces a quarterly loss of $91,000. After a loan of $180,000, Broo has $71,000 cash on hand at end of the quarter.

28 February 2020 |Half Year Results and Report

Broo reports a loss of $1,325,579 for the half-year.

Notes:

- On 8 January 50,000,000 shares issued at $0.01 raising $500,000

- on 31 January Broo issues 15,000,000 unlisted options with an exercise price of $0.02 expiring on 8 January 2022 as “consideration for advisory services to be provided”.

- The company still in negotiations for outsourcing brewing requirements which will provide an efficient supply chain and provide an opportunity for significant expansion into further distribution channels.

- Outsourcing will provide the company with “opportunity to rearrange its asset mix to optimise returns for shareholders”.

- Board is in negotiations with several parties for further funding.

*Significantly, this half-year report doesn’t provide operating segment information on China, effectively confirming that there is no production ongoing in that country. No notice has been provided in relation to the Jinxing supply agreement.

Auditor notes that in addition to the loss, Broo has a working capital deficiency of $3,572,064.

17 March 2020 | Kent Grogan sells share parcel

ASX notified that on 13 March Kent Grogan (Groges Holdings Pty Ltd) sold 40,000,000 shares off market for a price of $400,000 ($0.01).

30 April 2020 | Quarterly Update (COVID)

Reports a cash loss of $1,209,000 for the quarter.

Broo issues market update in light of Covid-19 saying that it will continue operations, albeit on a scaled-down basis until the COVID-19 restrictions are relaxed overcoming months. Broo has “experienced a drop in trading activity during the March quarter” due to the effects of COVID-19, however, the company is actively managing a very difficult economic environment and is seeking out new opportunities with potential strategic partners. Mildura Brewery continues to produce beer under its existing sales arrangements and the company remains focused on increasing domestic sales and distribution. Sorento brewhouse and Mildura pub have closed temporarily due to COVID-19 restrictions.

There is no update to the arrangements in China.

10 June 2020 | Trading pause, response to ASX query

On 10 June the ASX halts trading on Broo shares and issues a query regarding unusual trading activity and share price fluctuations.

Broo Share Price close 10 June 2020

26 June 2020 | Broo issues further shares

Broo announces a private placement of 13,333,332 additional shares at a price of $0.015. The placement is managed by 61 Financial Technology Pty Ltd which charges a 6% brokerage fee and 2% management fee.

31 July 2020 Fourth Quarter report

Reports an operating loss of $137,000 for the quarter and restates operating information from 30 April quarterly report, adding that:

- the company is reviewing, in conjunction with its corporate advisor, assets that may be surplus to the core activity of beer production and sales,

- Broo is assessing a range of longer-term sources of capital of a strategic nature that can assist it to expand its operations.

12 August 2020 | Contract brewing agreement CUB

Broo announces the signing of a contract brewing agreement with CUB. The (CUB agreement) is for two years and Broo anticipates placing orders of 48,000 cases (24 x 375ml bottles or 432,000 litres) on a quarterly basis. Broo intends to place first beer order with CUB in October 2020.

26 August 2020 | Share Issue

After a trading halt on 24 August at the company’s request, Broo announces plans to raise funds for the first contract purchase from CUB, and provide working capital by undertaking a share and rights issue:

- Issuing 70, 274,770 shares @$0.018 ($1,264,945.86)

- Issuing 35,137,385 options exercisable at $0.03 expiring 31/10/2022 (attached to above on a 2-1 basis)

- In parallel, Broo announces a non-renounceable pro-rata rights issue of new shares @ $0.018 per share for every five shares held, up to 156,068,102 new shares.

- One option with an exercise price of $0.03 cents, expiring 31 October 2022.

The placement is managed by 61 Financial Technology Pty Ltd, which managed the 26 June 2020 share issue. charges a 6% brokerage fee and 2% management fee, and 15,000,000 listed options exercisable at $0.03 expiring 31/10/2022. The lead manager is still owed $45,000 from the earlier placement

“The company has received firm commitments for $1,254,945.86 from sophisticated and professional investors…”

The rights issue aims to raise a maximum of $2,809,225. The $1,254,945.86 is applied to the CUB agreement, as is $1.5 million from the rights issue.

The prospectus issued on 31 August reveals that in addition to the above fees related to the issue, 61 Financial Technology Pty Ltd is also receiving a monthly retainer of $15,000 for acting as Broo’s corporate advisor, as well as 20,000,000 options. If shareholder approval is not granted for the options, a fee of $100,000 is payable.

31 August 2020 | Market update and preliminary update

Preliminary results reveal a loss of for the year of $3,508,245 and in the financial notes that the Sorrento Brewhouse has been disclosed as a discontinued operation with the assets classified as held for sale. Despite this note buried in the financials, there is no mention of plans for the site in the Market Update. The update does note that Mildura Brewery will shift production focus to “premium craft offerings and on-premise keg production”.

The Ballarat project (World’s Greenest Brewery) finally gets a mention, noting it will be “receiving renewed emphasis this current financial year, with a plan to secure the various development approvals”.

21 September 2020 | Annual Report

The company reported a loss for the year of $3,482,245, taking the accumulated loss since 2014 to $20,607,415.

The board has entered into a sales contract for the Sorrento Brewhouse for $60,000. The venue reported a loss of $348,412 for the year ($120,486 in 2019)

China is no longer reported in the financial notes under operating segments, although it is still regarded as a reportable operating segment. It is not covered under the Impact of Covid-19 in the notes to financials.

Notes a mortgage over the Ballarat property with interest charged at 12%, expiring 6 February 2021. A title search shows this was entered into on 3/2/20 and is in favour of Skyrim Investments Pty Ltd (ACN 621938681).

Hong Kong-based subsidiary Broo (HK) Limited (HKCo) is listed as a subsidiary, although Hong Kong business records show this entity was “Dissolved by Striking Off” on 29 May 2020.

25 September 2020 | Rights Issue Results & Shortfall Notification

Broo advised that it had received applications from shareholders for a total of 122,409,549 ordinary shares at $0.018 per share, and also 61,204,775 attaching options (exercisable at $0.03 on or before 31 October 2022) thus raising $2,203,372.24 (before expenses) of which 1,115,182.24 were received in cash and the remaining balance of $1,088,190 (non cash amount) was satisfied by way of a set off against the debt owed by the company to its director Kent Grogan and or his associated entities. The board approved for the director loan to be partially set off against the application monies payable by Mr Grogan and his associated entities under the rights issue reducing the outstanding amount of the director loan from $1,314,442.52 to $226,252.52.

2 October 2020 | Change in Director’s Interest Notices / Placement of Rights Issue Shortfall

Notices files showing:

- Kent Grogan has acquired 200,000 shares and 100,000 listed options ($0.03 exc 31 October 2022) taking his interest to 1.2 million shares and 100,000 listed options

- Groges Holdings Pty Ltd 60,255,000 shares and 30,127,500 listed options ($0.03 exc 31 October 2022) taking his interest to 361,530,000 shares and 30,127,500 listed options

- Matthew Newberry has acquired 401,500 shares (@ $0.018 totalling $7,227) and 200,750 listed options ($0.03 exc 31 October 2022) taking his interest to 2,409,000 shares and 200,750 listed option.

Placement of 33,658,740 shares at $0.018 and 16,829,373 attaching options ($0.03 exc 31 October 2022) raising $605,857 before expenses.

30 October 2020 | Quarterly Accounts and Market Update

Broo reports a cash loss for the quarter of $1.075,000, inclusive of manufacturng and operating costs of $904,000.

Brookconfirms it has placed its first order with CUB under its contract brewing agreement, with the first production run being due in December 2020 with production costs of $904,000 (on 22 December it updates to note that $777,000 was product manufacturing pre-payment).

Referencing of the Ballarat Brewery / ‘World’s Greenest Brewery’ has resumed, though witout a meaningful update on plans, planning applications or funding two and a half years after purchasing the property that is subject to a mortgage and also a call option.

(Ed’s note: Based on its earlier announcement that the contracting agreement was for 48,000 cases – 24 x 375ml bottles or 432,000 litres – on a quarterly basis, and assuming the $777,000 is for the first quarter’s order, Broo is paying $16.18 per case. Excise on a carton of 24x 375ml at 4.2% abv would equate to $14.37, seeing cost-per-case for Broo Premium Lager totalling $30.56. Broo Premium Lager is currently retailing through East End Group for $37.99. If Broo prepaid for more than the first quarter order, margin of $7.33 may increase. Note it competes against the CUB-owned Great Northern, produced at the same facility and with the same production costs and retails for $45.99.

Assuming [1] the above and [2] Broo receives payment in full for these during the quarter, and [3] Broo and East End split the apparent profit, Broo will be paid $34.23 per case or generate revenue of $1,643,040 from its brewing operations in the next quarter with a profit of approximately $175,680. Its staff and administration costs for the last quarter were over $400,000.)

18 November 2020 | Change in Directors Interest Notices

Following approval granted at its annual general meeting, shares were granted to Directors Mathew Boyes and Matthew Newberry in lieu of fees payable.

- Mathew Boyes via Mench Investments Pty Ltd ATF Harper Investments A/C 2,000,000 shares and via Harper Group Superannuation Fund Pty Ltd ATF Harper Group Superannuation Fund 1,244,444 shares and 1,622,222 listed options @$0.018. Taking holding to Mench Investments Pty Ltd ATF Harper Investments A/C – 4,500,000 and Harper Group Superannuation Fund Pty Ltd ATF Harper Group Superannuation Fund – 1,244,444 shares and 1,622,222 listed options and Mench Investments Pty Ltd ATF Boyes Family A/C.

- Matthew Newberry: 3,244,444 shares @ $0.018) and 1,622,222 listed options. This took holding to 5,653,444 shares and 1,822,972 listed options.

9 December 2020 | Completion of CUB Production

Announces it has received the first production under the CUB agreement.

(Ed’s note: Seems an odd announcement to make given it has provided no updates on its Jinxing supply agreement, for which it has incurred production costs in the last of less that $10,000 over the previous two years. “Continuous disclosure” appears to be only for triumphal and postive announcements, not material supply and contract issues relating to China for which it is promising significant income streams.)

22 December 2020 | Updates Quarterly Accounts and Report

Updates cash flow report to note production costs of $777,000.

4 January 2021 | Termination of Agreement with Beijing Jihua

Broo notifies the ASX that it has terminated its distribution agreement with Jihua agreement, advising that it considers Jihua in default of its agreement for its failure to make payments to Broo Exports with respect to royalties due under its agreement, which were due in December 2020.

The company is reviewing its legal position again Jihua and shall determine an appropriate course of action.

(Ed’s notes: Broo’s 2016 prospectus identifies difficulties enforcing contracts in jurisdictions other than Australia as a risk to the company. Further, the last time that the company recorded significant costs against its China operation was $34,099 in its 2017 Annual Report. Subsequent to this report it booked less than $10,000 costs against China. Given its China supply was contracted in China under the Jinxing supply agreement, it would be reasonable to assume that the company would have had concerns about the likelihood of receiving the Jihua payments for several years on the basis that it was not reporting any production and presumably supplying beer.)

Glossary / Details

Ballarat Brewery / ‘World’s Greenest Brewery’

Artist’s rendering of proposed World’s Greenest Brewery.

On 17 February Broo announces the purchase of 15 hectares of industrial land in Ballarat within the Ballarat West Employment Zone (BWEZ) for $2.16 million with plans to develop a major brewery over the next 24 – 26 months. The company says the brewery will be capable of producing up to 480 million bottles of beer (*180 million litres, based on 375ml) “making it one of Australia’s largest breweries”. It obtains quotes from Krones and Decibel Architecture ‘wins a competition‘ to develop concept plans.

In a market update in March 2017, Broo said it would be seeking to obtain the necessary planning and development permits for the project within 12 months. The Ballarat Courier advised that as at 20 February 2019 no planning application had been received. Similarly, no applications had been received by 2/3/2019 & 6/8/2019.

In its first annual report following the IPO, Broo advised that the Ballarat land was valued at $2,123,404 and was subject to a call option where Broo has granted the vendor the option to buy back the land at the vendor’s discretion in the event that Broo defaults on its obligations to complete the development of a commercial brewery at the site and ensure that at least 100 full-time employees are employed at the site within five years of settlement. This call option is subject to a loan to Manda Capital detailed in the first annual report.

Beijing Jihua Information Consultant Ltd (Jihua)

On 27 November 2017 Broo announces it has entered into a binding agreement with Beijing Jihua Information Consultant Ltd (Jihua) to market and distribute Broo Premium Lager for 7 years.

The exclusive agreement will “enormously accelerate the expansion of Broo Premium Lager” in the “lucrative Chinese beer market”.

Jihua will purchase Broo Premium Lager from Broo’s approved manufacturer in China and Jihua will fund the marketing and promotional costs for the brand. The agreement is “binding on a ‘Take or Pay’ basis for 1.5 billion litres of beer over the 7 years with Jihua paying a fixed rate per litre. Broo predicts revenue of RMB602 million, or approx AUD $120 million.

Jihua commits to significant upfront marketing and advertising funds and Broo defers revenue payments for three years with payments continuing on a 6-monthly basis thereafter.

No mention is made of Jinxing supply agreement or Henan Liquor distribution agreement.

On 30 April 2018 Broo advises Jihua has commenced sales and distribution, including to its major customers COFCO and Wumei Ltd (Wu Mart Supermarket Chain) covering more than 20 cities and districts. Jihua has “received great feedback from customers and is looking forward to a successful summer”

on 25 October 2018 notifies China wholesale volume of 19.2 million litres, “in line with the Year 1 forecast expectation of the binding agreement”. China distribution focusing on “rural areas including second and third-tier cities.”

Broo (HK) Limited (HKCo)

The Hong Kong Government’s Integrated Companies Registry Information System (ICRIS) register shows this company was incorporated in Hong Kong on 3 June 2016 and was “Dissolved by Striking Off” on 29 May 2020. The registered address was Unit 1501, 15/F Bangkok Bank Bldg 18 Bonham Strand West, Sheung Wan, Hong Kong. The sole director was listed as Kent Brian Grogan.

Broo Profit/Loss

[table id=24 /]

China Supply Agreement (Jinxing)

Entered into in June 2015 The Prospectus advises that the company has entered into agreements to undertake production and distribution of Broo Premium Lager within China (Jinxing Beer Group Co Ltd). This was a five-year exclusive agreement with Jinxing to produce Broo products in China.

On 28 October 2016 Broo announces Jinxing will now also distribute the beer made under the supply agreement.

In its first annual report company advised it was expected to secure revenues from China sales during the 2018 financial year and was negotiating further distribution agreements.

China Distribution Agreement (Henan Liquor)

Entered into in June 2015. The Prospectus advises it has entered into a non-exclusive distribution agreement with Henan Liquorstore Commercial Chain Management Co Ltd (Henan Liquor), a chain of 260 alcohol outlets in Henan province and Beijing known as Liquor Easy. At date of the prospectus, Broo distribution ‘has not yet commenced in China’. A portion of the funds to be raised under the 2017 listing were to go to commence production and distribution under these agreements.

Contract brewing agreement with CUB (CUB agreement)

In August 2020 Broo announces the signing of a contract brewing agreement with CUB. The agreement is for two years and Broo anticipates placing orders of 48,000 cases (24 x 375ml bottles or 432,000 litres) on a quarterly basis. Broo intends to place first beer order with CUB in October 2020.

December 2020 – announces quarter production under CUB agreement of $777,000. Based on its earlier announcement that the contracting agreement was for 48,000 cases – 24 x 375ml bottles or 432,000 litres – on a quarterly basis, and assuming the $777,000 is for the first quarter’s order, Broo is paying $16.18 per case. Excise on a carton of 24x 375ml at 4.2% abv would equate to $14.37, seeing cost-per-case for Broo Premium Lager totalling $30.56. Broo Premium Lager is currently retailing through East End Group for $37.99. If Broo prepaid for more than the first quarter order, margin of $7.33 may increase. Note it competes against the CUB-owned Great Northern, produced at the same facility and with the same production costs and retails for $45.99.

Assuming [1] the above and [2] Broo receives payment in full for these during the quarter, and [3] Broo and East End split the apparent profit, Broo will be paid $34.23 per case or generate revenue of $1,643,040 from its brewing operations in the next quarter with a profit of approximately $175,680. Its staff and administration costs for the prior quarter were over $400,000.

Delacombe Town Centre / Broo Burger Bar

Announced on 29 March 2017, Broo said it had entered into Heads of Agreement for the lease of a site in Delacombe in the “western growth centre’ of Ballarat. Located in the town centre, the company intends to establish ‘a hospitality and bar operation’. Site currently under development, but handover anticipated for November 2017. Operation will “expand its hospitality model and make an initial step to retail” beer in Ballarat where its ‘major brewery’ will be located.

Ballarat Courier notes that in April 2017 the company announced plans to open a Broo Burger Bar at the Delacombe Town Centre, but the proposal was dropped in November last year, with the directors noting they would be better served by focusing Ballarat operations on the BWEZ development.

East End Group

After asking for a trading halt on 6 August, Broo announces it has entered into a trading agreement with “Queensland independent wholesale network, the East End Hotel Group”. The agreements provide East End with “exclusive Queensland distribution rights” for Broo Premium Lager (4.2%) a new product.

Distribution rights subject to East End meeting annual sales targets of 2 million litres during the initial 12-month term from August 2019.

“The East End distribution network comprises established wholesale and retail operations that collectively rank as one of Queensland’s largest independent wholesalers. Over the past six months East End has grown to be one of Broo’s most valued trading partners, with proven distribution capabilities of brews existing products.”

The 2 million litre claims are made despite Broo producing its beer at its Mildura Brewery which can only produce 1.5 million litres per year and also having also reported significant production cost reductions over the previous two quarters.

The “East End Hotel Group” is the East End Hotel and three associated bottleshops in Bundaberg. BrewsNews understands that the venue buys significant volumes of Broo with industry sources describing the model as “cheap beer in a low economic area”. East End Hotels Group told Brews News it sells cartons of Broo Premium Lager at a regular price of $37.99, whilst the Australian Draught, also at 4.2% abv, is sold for $39.99. Excise on a carton of 24x 375ml at 4.2% abv would equate to $14.37.

Gem Syndication Pty Ltd

On 8 January, Broo advised the ASX that Gem Syndication Pty Ltd has become a substantial shareholder as a result of Kent Grogan’s sale. The purchase of 60,000,000 shares from Kent Grogan gave Gem Syndication 8.61%, of the company at $0.016 per share.

ASIC records show that Gem Syndication Pty Ltd is owned by another company, CEA Syndication Pty Ltd, with Teik Leong Siah listed as a director. The Australian Business Register records Adrian Siah as the trading name of Teik Leong Siah. The registered address for Gem Syndication is Gem Realty.

Mr Siah has been registered as a licenced estate agent in Victoria since 2014, and is listed as an agent at a number of Melbourne-based property firms, including Gem Realty (profile deleted after questions from BrewsNews) and red23 Real Estate. His agent profile describes Siah as “a career accountant turned real estate professional”. He is also on the board of The Environmental Group Ltd, where he is described as having ” as well as broad connections in the investment community and in South East Asia.”

In its 31 August Rights Issue prospectus, Broo notes that GEM Syndication Pty Ltd is the registered owner of 20,000,000 shares (representing 2.56% of the total voting power) and holds an indirect relevant interest in 40,000,000 shares held by other registered shareholders (which represents 5.13% of the total voting power).

Mildura Brewery

Purchased in February 2017 for $1 million for the brewery. Grogan said he was confident the facility could produce five million bottles a year. The business repeatedly states the facility “will significantly reduce current production costs in turn providing increased profitability across sales of existing brands”.

By first Annual Report, Broo reports brewery has been improved and is capable of producing 1.5 million litres per year (*4 million bottles).

The annual report also explains that when Broo acquired the Mildura Pub and Brewery leasehold businesses, the vendor required both the businesses and the land and the buildings be bought. Broo Ltd did not want to commit to the purchase the land and buildings. Mildura Brewery (AUB) Pty Ltd, acquired the land and building and leased them Broo on ‘arms-length market rate terms’. Broo lent Mildura Brewery (AUB) Pty Ltd $250,000 at 10.5% per annum repayable within two years. Mildura Brewery (AUB) Pty Ltd was registered on 21/12/2016 with Grogan AUB Pty Ltd and De Graaff AUB Pty Ltd each having a share. On 26/02/2018 De Graaff AUB Pty Ltd assumed 100% ownership.

The annual report also notes the acquisition of the Mildura Brewery Pub as a going concern for the cost of $200,000 with the full amount being the cost of Plant & Equipment. No value was assigned to goodwill.