Online liquor delivery numbers slow

Fewer people had online liquor products delivered in 2021, as more gravitated towards click & collect, according to recent data by IRI Australia.

The market research company recently held its ‘eCommerce Expansion’ webinar in collaboration with Growth Scope, which provided insights on how eCommerce data from the calendar year of 2021 affected the liquor market.

Areas of focus included market performance, liquor occasion, consumer perspective, shopper perspective and product/service trends.

The data found a six percentage point decrease in people buying online and having products delivered compared to 2020. In contrast, the data also found an increase in click & collect from 47 to 55 per cent.

“So this goes to show that even though with restrictions easing and people being able to go out and go to the shops and shop, people are still opting to buy things online,” IRI Australia senior consultant – liquor & tobacco Ishakya Gunaratne said during the webinar.

“But rather than it being delivered, they’re now going into store and going for the click and collect option.”

During the peak of the pandemic, deliveries were instrumental for many breweries to stay afloat but with restrictions easing and the introduction of Liquor & Gaming NSW’s age verification for same day alcohol delivery, the business model may continue to decline over the next few years.

Growth Scope research and product director Mel Anderson explained that it’s also a matter of convenience for shoppers.

“What is the actual definition of convenience in the eye of the beholder?”

“So for some people convenience could be ‘I find it challenging to navigate websites and credit card payments over the internet and therefore that’s a problem for me.’

“Others might go ‘that’s not a problem, but I don’t like dealing with Australia Post.’

On the flip side, others might be ‘I just don’t want to have to wait, I want it now.’ So that’s their definition of convenience and timing.

“I think there’s a huge role in that and into the psyche of individuals and how they see the world.”

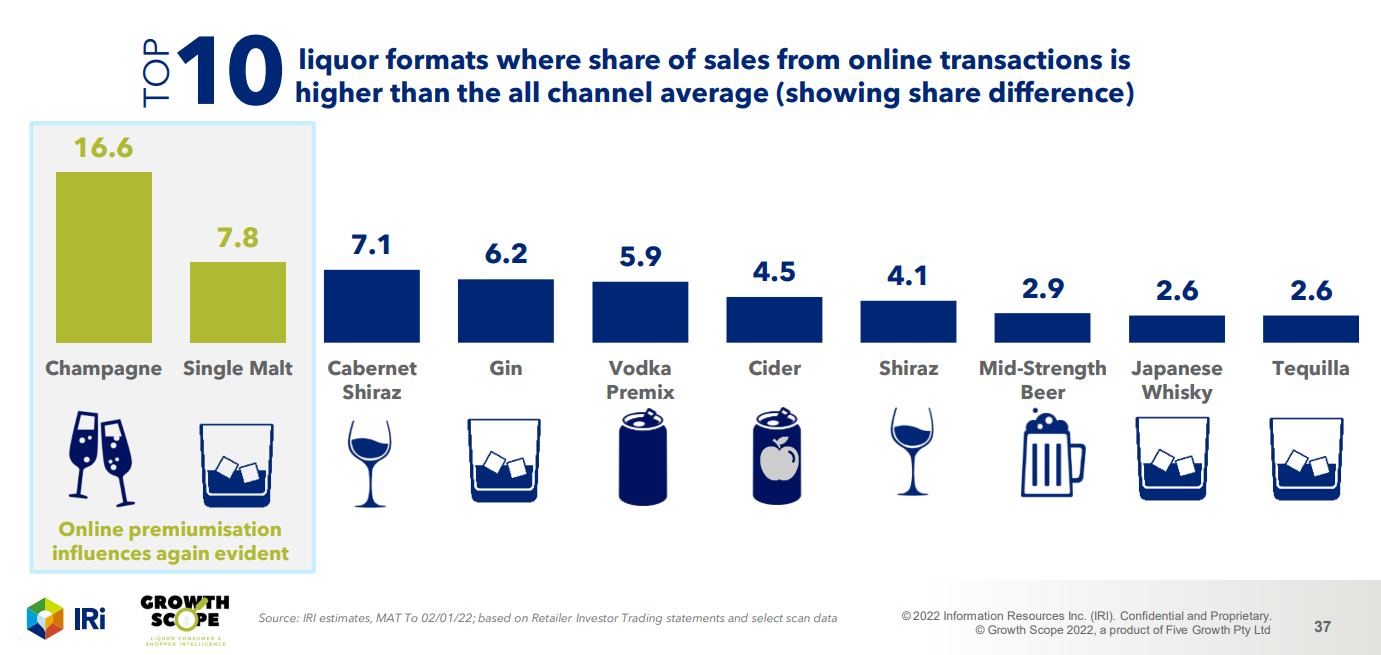

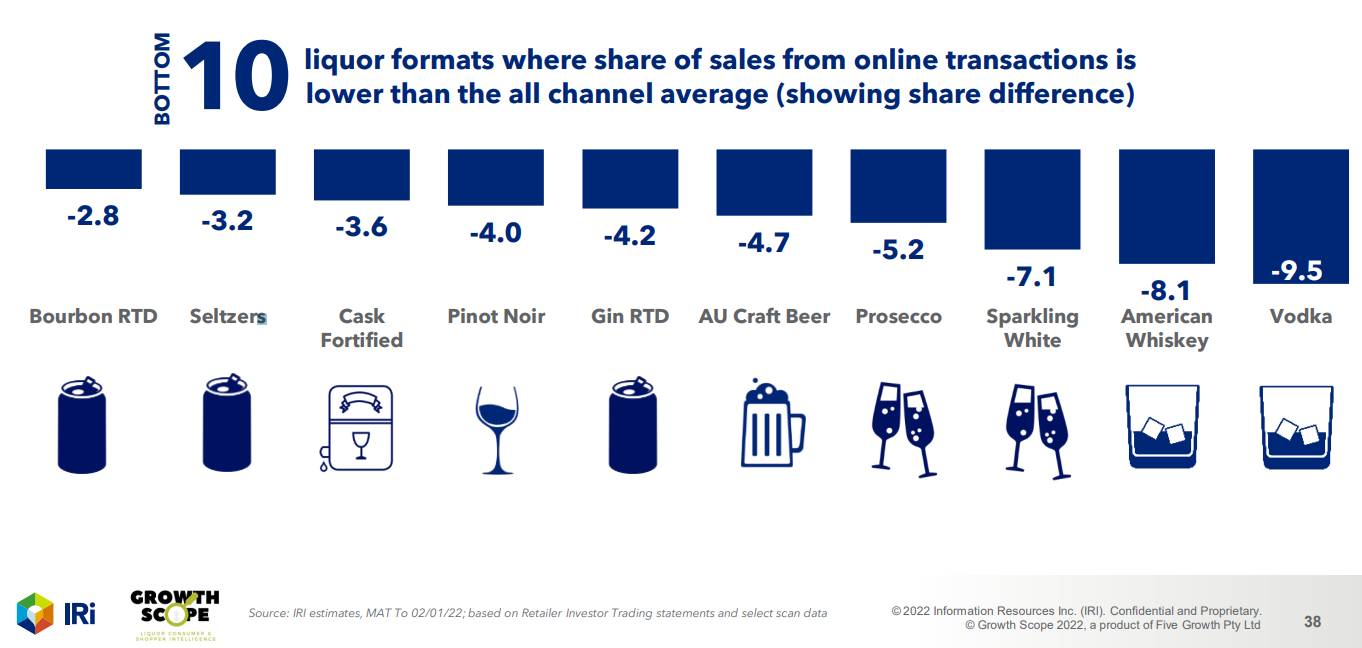

Mid-strength beer landed in the top 10 liquor formats of online purchased products versus in-store. Meanwhile, Australian craft beer was listed in the bottom 10 liquor formats that were purchased online compared to in-store.

Anderson elaborated on this further and explained how craft beer is a smaller category to base results on.

“I think what we’ve shown is that craft beer buyers are less than other types of beer buyers, because it is a smaller category, not necessarily that it’s relative to online smaller,” she said.

“The opportunity for craft who may be a challenge to get ranging in some other larger bricks and mortar retailers and therefore increase their distribution presents an opportunity for them to really leverage the online channel as a way of broadening their touch base because you don’t have to live or you’ll be near the physical brewery to be able to buy the craft beer.

“If it’s available online, you could be anywhere in the country and order it and get it delivered. So enable that accessibility which may not be possible because you’re not ranged in one of people’s local bottleshops or supermarkets stores.”

Retailer performance

Endeavour Group, which owns BWS and Dan Murphy’s, performed strongly in 2021, with online sales resulting in $859 million, 6.3 times higher than Coles Liquor, owner of First Choice and Liquorland bottleshops.

It is important to note that eCommerce sales data excluded liquor sold through coles.com.au, which is reported in supermarkets’ eCommerce sales.

Earlier this year, Endeavour reported that online sales had reached $1 billion while Coles said its liquor eCommerce sales grew 50.1 per cent to $33 million for the third quarter of the 2021 financial year.

In terms of customer penetration numbers, which refers to the number of new customers that shop online, Endeavour had a 2.2 percentage point increase in the first half of 2022, which can be attributed to its omni-channel presence, according to IRI Australia’s Ishakya Gunaratne.

“Endeavour Group has been able to reach out to that same shopper online and in store as well because 25 per cent of Endeavour’s customers who visited online, also shopped in store and they’ve done a terrific job in driving that to digital traffic.”

Dan Murphy’s and BWS had a 56 and 81 per cent increase in online transactions over the course of 2021.

The full eCommerce Expansion webinar is available to watch online now.