Two-thirds of US seltzer switching gains come from beer

Almost half of hard seltzer growth in the US is coming from drinkers who are switching from the beer, wine and spirits category, with two-thirds of that number switching from beer according to data presented by global big data and consumer insights specialist, IRI.

In a virtual presentation titled Leveraging the Hard Seltzer Opportunity Lachlan Cameron, IRI consultant within the liquor sector, said that the company’s data showed that beer’s popularity amongst younger generations had waned, with millennials less engaged with almost every major beer in the US than preceding generations.

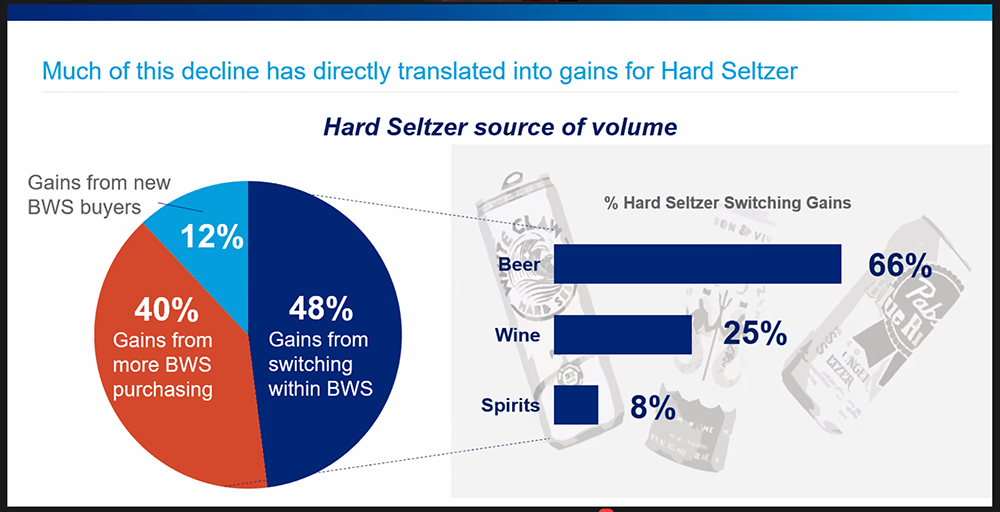

“When we look at the switching data, and this is the source of volume for hard seltzers, we see that 48 per cent of hard seltzer’s volume is coming from switching from other categories within beer, wine and spirits,” he said.

“Two-thirds of that volume is coming from beer, so there’s a clear link between beer and that shifting preference.”

He said there was also 12 per cent of volume came from new beer, wine and spirit buyers.

“Ths really speaks to the proposition that hard seltzer offers, it offers something different and is attracting people to the total liquor category that hadn’t previously been purchasing liquor.

“It’s a new and novel proposition that is really resonating with a broad audience.”

The switching was identified as predominately coming from mainstream beer in the US and IRI said is still too early in Australia for any real indicators. IRI will be in a position to provide some switching analysis for Australia in the new year.

Beer’s loss is seltzer’s gain

IRI’s data showed that alcoholic seltzer is now worth $1.8 billion in the United States, seeing growth of 233 per cent in 2018 and 350 per cent last year.

Cameron said IRI was bullish about the category in Australia and it represents a $300 million opportunity by 2025 in Australia, though new brands face challenges.

While the US market is substantial and has seen a ten-fold increase in the number of brands, just six brands represent 96 per cent of total value. Distribution and large marketing support were identified as key drivers for the six brands.

In Australia, the newness of the category means seltzer will have to fight even harder to get noticed and brands must educate consumers about the benefits to justify the premium price.

However, Cameron warned, functional messaging alone will lead to a lack of differentiation with big brands and small brands playing a differing role in the emerging segment.

He identified that big brands will serve to generate segment awareness and educate consumers on the ‘functional’ benefits.

“On the flip side, smaller brands have a somewhat different role, their role is to really differentiate and stand out on the shelf and to carve out their own profitable niche, which will ultimately serve to broaden that segment appeal,” he said.

The data was presented at an IRI Category Insights Virtual Event. The full presentation can be viewed here.

Interested in learning more about the techniques for making hard seltzer? You can listen to our BreweryPro podcast with Bintani and Fermentis.